The U.S. House of Representatives passed a bill Nov. 18 cutting almost $15 billion from the federal student loan program.

The bill, which passed 217-215, will increase interest rates on student loans and decrease the amounts that some students may be able to borrow, a recent Congressional budget office report said. The report estimates an increase in student costs of $5.5 billion.

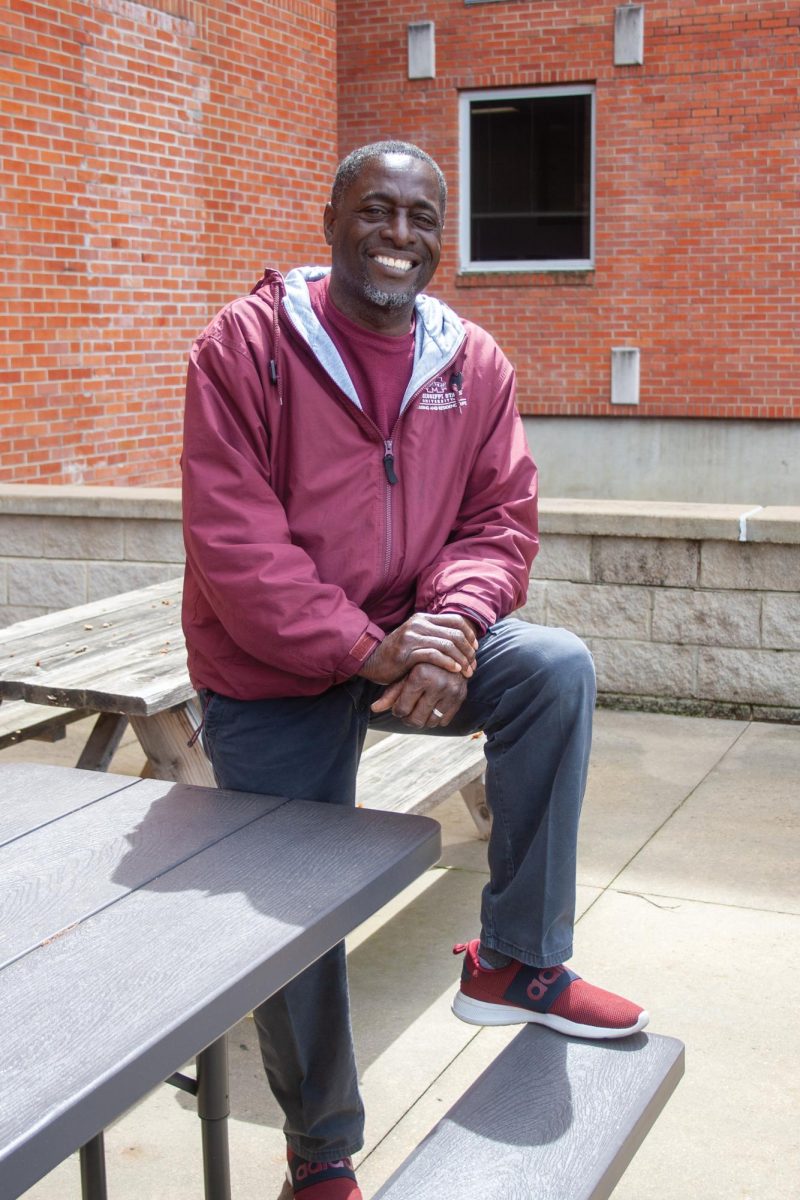

Mississippi State University director of financial aid Bruce Crain explained the effects this bill may have on MSU students.

“If a bill of this type passes both houses of Congress and is signed by the president, then we will see two basic results that impact student aid programs,” Crain said.

“The amount of financial subsidies that federal student loan lenders receive from the federal government to help offset the costs of providing federal students loans will be reduced,” he said.

For the average college student, this might mean an increase in the cost of borrowing, probably in the form of origination or processing fees, Crain said.

Another way the bill will affect the 9,000-plus students receiving loans at MSU coincides with increasing interest rates. However, the higher rates will not affect the amount a student borrows, Crain said.

“Keep in mind that there is no mention of reducing the amount of loans students can borrow per year, only that borrowing may be more expensive in terms of processing fees and interest rates.”

Some feel that the cuts to federal student loans will be an unnecessary hit to higher education and that the bill may have ulterior motives.

“A cut of $15 billion is a huge blow,” Christine Lindstrom, program director for the student Public Interest Research Group, said. “The cuts in this budget bill actually are tied to a $70 billion tax cut for the wealthy and corporations.”

Rep. Tammy Baldwin (D-Wis.) agrees.

“These cuts are just one more example of this administration and Congress seeking to enrich the few at the expense of the Others feel America’s spending is spiraling out of control and must be dealt with as soon as possible. The national deficit increased wildly after Katrina and Rita hit, draining already shallow resources. The cuts, though they may hurt education, will help the economy, some say.

“This unchecked spending is growing faster than our economy,” Budget Committee Chairman Jim Nussle (R-Iowa) said. “Spending is growing faster than inflation and far beyond our means to sustain it.”

While most agree that national spending continues to increase at an alarming rate, opponents of the five year deficit-reduction bill feel that this cut is not the way to deal with a problem that won’t be solved quickly.

“Instead of making drastic cuts to higher education, we should be investing more in the skills of a new generation of students so they can succeed in today’s global marketplace and make America’s economy stronger,” Rep. Ron Kind (D-Wis.) said.

Crain said MSU students do not need to worry about finding federal funding for college.

“Certainly the effects of the recent hurricanes have us all concerned about those who suffered the most but also about our state economy and federal economy,” Crain said. “I do not yet see where any legislation at the federal or state level has been passed that will make a significant change in the amount of financial aid students can receive each year,” he added.

The decreased student loan budget, along with $35 billion in reductions in welfare, Medicaid and other public service programs, are an attempt to decrease the national deficit and allow for tax cuts.