Mississippi tax collections, which some thought would be brought down by Katrina, are up almost $20 million above this year’s estimate, according to statistics from the Mississippi Department of Finance and Administration. The increase covers taxes collected from July 1 through the end of October.

For October, tax collections were up $22.4 million above the state estimate. August and September reports indicated tax collections below the estimate, showing a significant jump in less than a month.

Gov. Haley Barbour’s spokesperson Pete Smith said that this estimate represents a positive step toward economic recovery.

“Any growth in collections of taxes will certainly benefit the state of Mississippi economically,” Smith said, “as well as during this time of budget uncertainty. Collections that come in and are positive will certainly aid the legislature.”

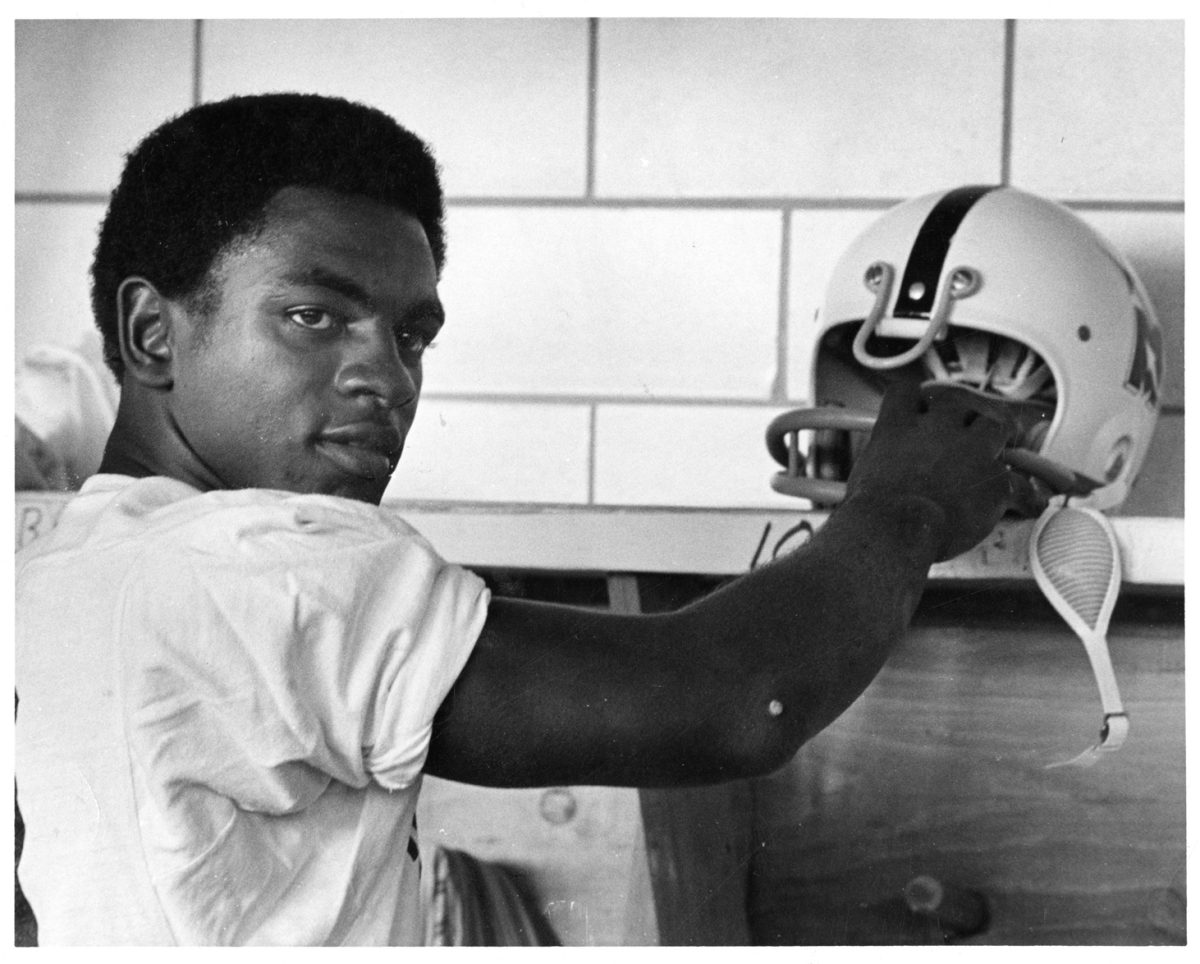

Rep. Cecil Brown, chairman of the state’s education committee, said the economy is doing better, but the full extent of Katrina’s devastation has not been felt.

“It will be interesting to see what happens in the next four or five months as the impact from Katrina starts hitting home,” Brown said.

Brown added that the Christmas season is the most important time of year for the state tax commission.

“Seeing how the collections reflect spending habits during the Christmas season will tell us a lot about what to expect from the state’s financial situation in the next six months,” he said.

Smith said that tax collections represent a healthy economy, but that expenditures also will influence these results.

“There’s so much uncertainty right now … funds coming in from the state, funds coming from the federal government. Katrina has left a void in the state budget,” he said.

If Mississippi can secure federal reimbursement for the Katrina-related expenditures, the state’s economy may not be as bad as lawmakers feared.

One key proposal going before Congress involves the federal government paying the entire cost of Medicaid in Mississippi. Typically, Medicaid’s cost is shared by the state and federal government. If the proposal passes, the state would save approximately $800 million in its first year.

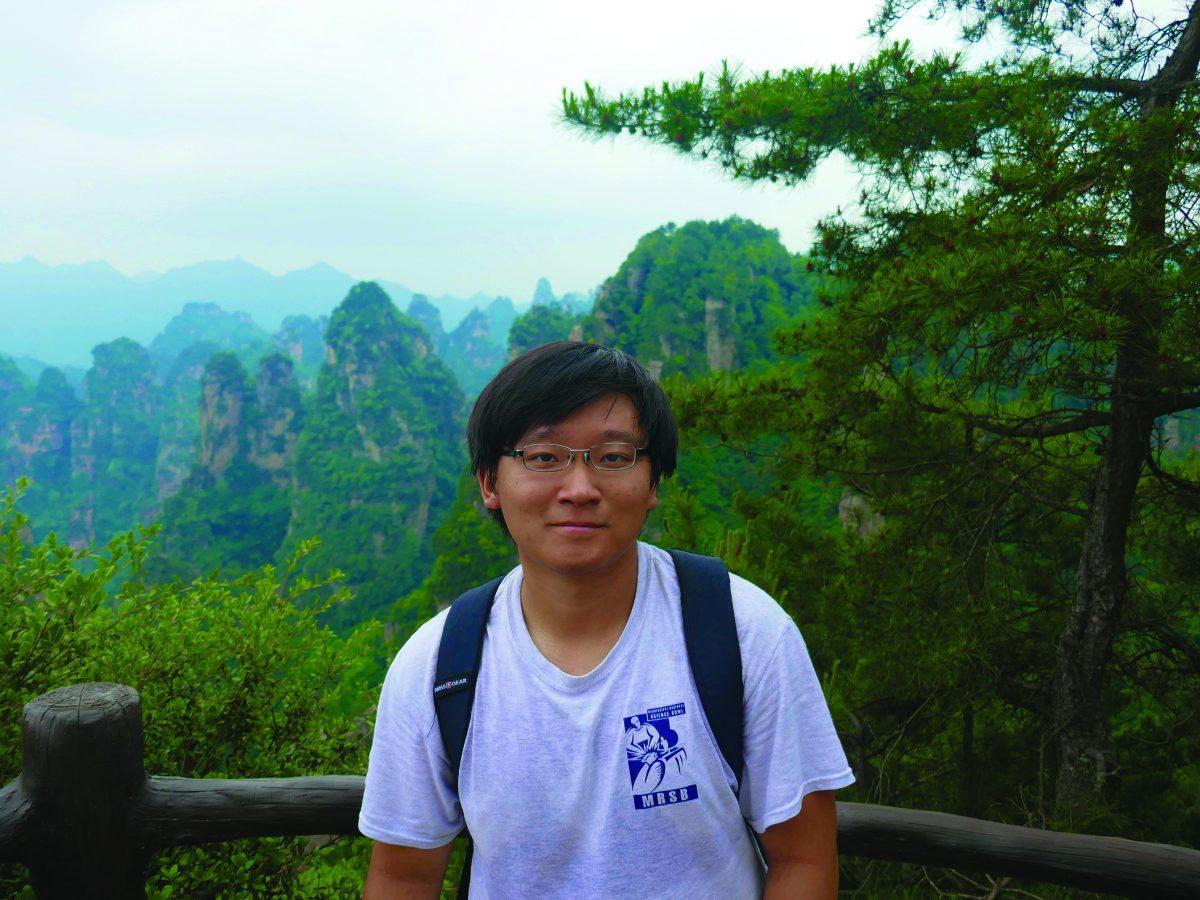

State economist Phil Pepper said that despite early concerns, the state’s economy will improve as rebuilding begins.

“There was real concern by a lot of people after Katrina that we would shoulder a lot of the clean-up cost, that there would be a downturn of revenues,” Pepper said. “What we’ve seen from other states … anytime you see rebuilding on this scale, the economy comes back strong.”

Pepper said that seeing positive results in October shows an optimistic future for Mississippi.

“For every billion that comes into the state, whether it’s federal or state insurance money, let’s say the state picks up 1 percent in revenue,” he said.

“That’s conservative, since state tax is greater than that, but you have 10 million out of a billion generated,” Pepper said.

“With all the money spent, that’s almost a grand total of 200, 400 … even 800 million dollars in revenues,” he added.

Brown said he agrees with Pepper’s assessment.

“There will be a lot of federal and state money going into rebuilding: homes being built, automobiles being purchased, jobs being created.”

Pepper said he believes that state lawmakers have handled their money well in the ways they have spent it thus far.

“When you start getting more money than you need, you start wasting it. We’re being good stewards of the taxpayers’ money,” he said.