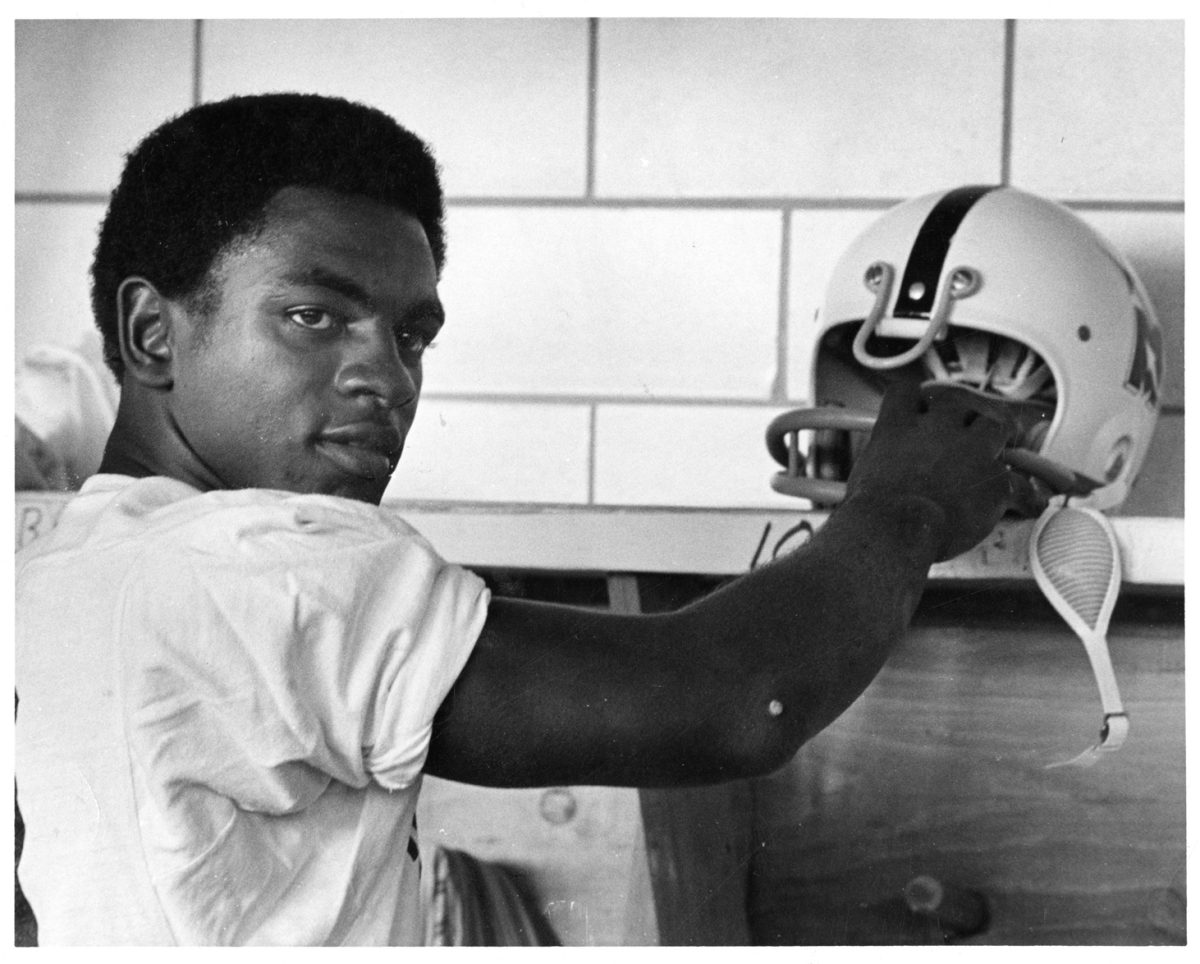

Tuesday, attorney and Harvard law professor Elizabeth Warren spoke to college journalists about her agenda as head of the newly established Consumer Financial Protection Bureau, an agency born out of the Consumer Protection Act of 2010.

Warren is the author of nine books and more than 100 scholarly articles on the subject of credit and financial security and was ranked by TIME magazine as one of the 100 most influential people in the world.

Warren said the Consumer Financial Protection Bureau will be a voice for families and younger Americans in advocating financial well-being and knowledge. It will also establish robust federal supervision of loans and will provide more college students with better financial education.

She said people ought to be able to read about credit cards and home mortgages and understand what they are reading.

“The time for hiding tricks and traps is over,” Warren said. “Half of younger households carry a credit card balance, with the median balance being $1,800.”

Warren said she wants to see young people make smart financial decisions based on an adequate understanding of what they are committing themselves to.

“Anyone who uses a financial product ought to be able to tell the cost and risks, upfront,” she said.

Warren said the current credit problem stems from two needs. The first is for more financial education, especially for young people, and the second is for financial documents to be more readable.

“They are often designed not to be read,” Warren said of their complex wording.

She said the Consumer Financial Protection Bureau will work to make products easier to understand and provide a big platform for financial literacy. Warren also said she wants to develop new approaches to make financial options more accessible and relevant.

A major problem Warren said college students face today is the complexity of student loans.

“Students are at the mercy of lenders,” she said.

She also said the new agency will work to re-balance the power between the borrower and lender. Too many consumer credit agencies pretend to sell something at one price and use tricks to sell it at a higher one.

However, Warren said she wanted to clarify this agency is not made to bail out students who are not mature enough to handle credit and who rack up debt with unnecessary purchases. Her organization is an advocate for the college student who may be looking to make ends meet during college and utilizing credit to buy books or pay student fees. Warren says all too often, in instances like these, she sees credit card rates raised exponentially and arbitrarily, and students are suddenly left swamped with debt.

Warren said she remembers a young college graduate she met who applied for a loan because of her family’s inability to pay when starting school. Because of a family crisis, the student fell behind in her payments, and no matter how much she paid, the balance of the debt never substantially decreased. She said she sees too many young college graduates, like this girl, suffering from debt at a time when they should be starting careers and families.

Warren said she is not entirely opposed to credit, and there are many good reasons to use credit, such as buying a house or in emergencies. She said her agency will help people who try to make educated financial decisions but suffer in the process.

“We’re here to level the playing field,” Warren said. “I’m excited to be in a place where substantial changes have been made.”