State Farm Insurance Co. announced Feb. 14 that it is suspending writing new commercial and homeowner policies in the state of Mississippi.

The suspension, which went into effect Feb. 16, was brought about by the political and legal climate of the state during the aftermath of hurricanes Katrina and Rita.

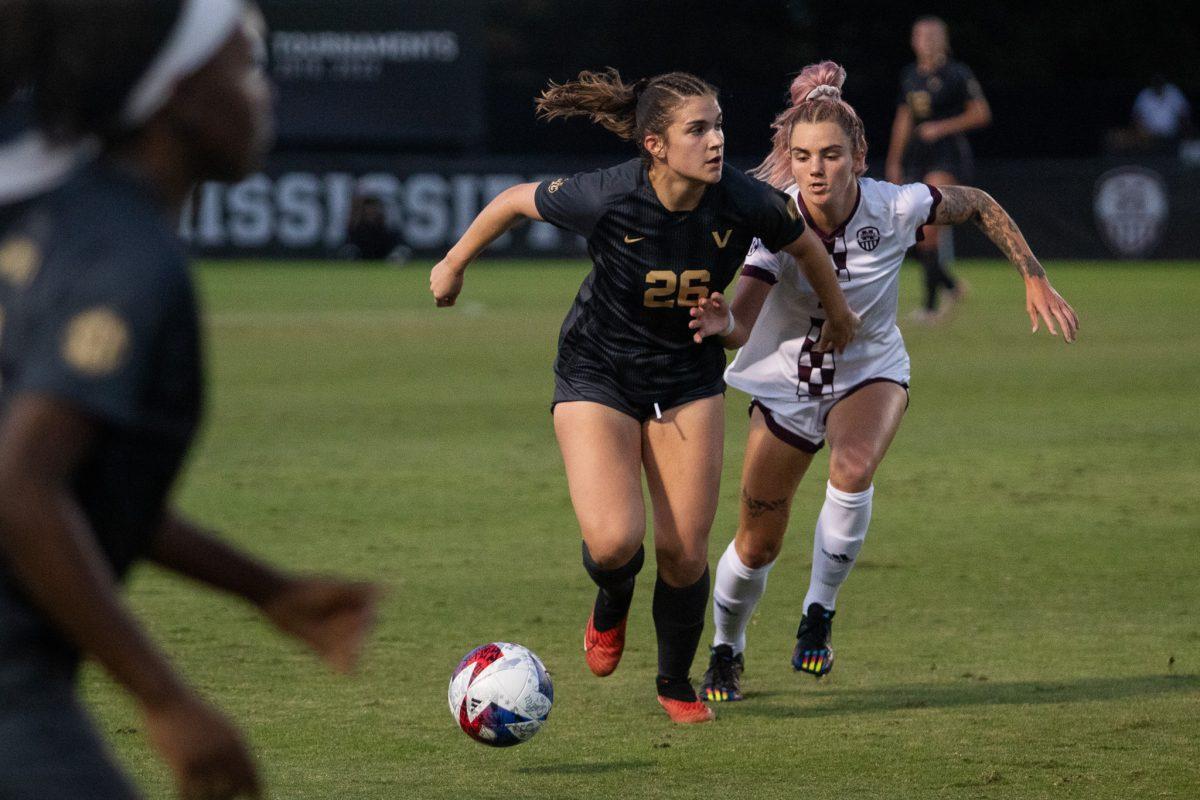

On Feb. 16, state attorney general Jim Hood announced his intentions to pursue legislation intended to stop State Farm’s suspension.

Hood said that his plans are based on legislative plans by Florida, another state that has battled losing insurance due to hurricanes and tropical storms.

The current legislation in Florida would need to be slightly modified to fit the needs of Mississippi, Hood said.

According to State Farm’s Web site, the company has managed more than 84,000 non-automobile insurance claims from Hurricane Katrina. State Farm has settled all but about 2 percent of all claims associated with Hurricane Katrina.

The Web site says that State Farm’s business in Mississippi increased in 2006, writing more than 76,000 new automobile policies and more than 29,000 new homeowner policies.

State Farm is the largest homeowner insurance company in Mississippi, holding approximately 30 percent of the homeowners market. It is the largest car insurer and home insurer in the United States.

State Farm will continue to serve current policyholders. It will also continue to write new automobile policies in Mississippi.

In a statement made to The Associated Press last week about his plans, Hood said any company that writes automobile insurance and also writes homeowners in any other state would be required to write or make available insurance for homeowners and commercial properties in all parts of the state.

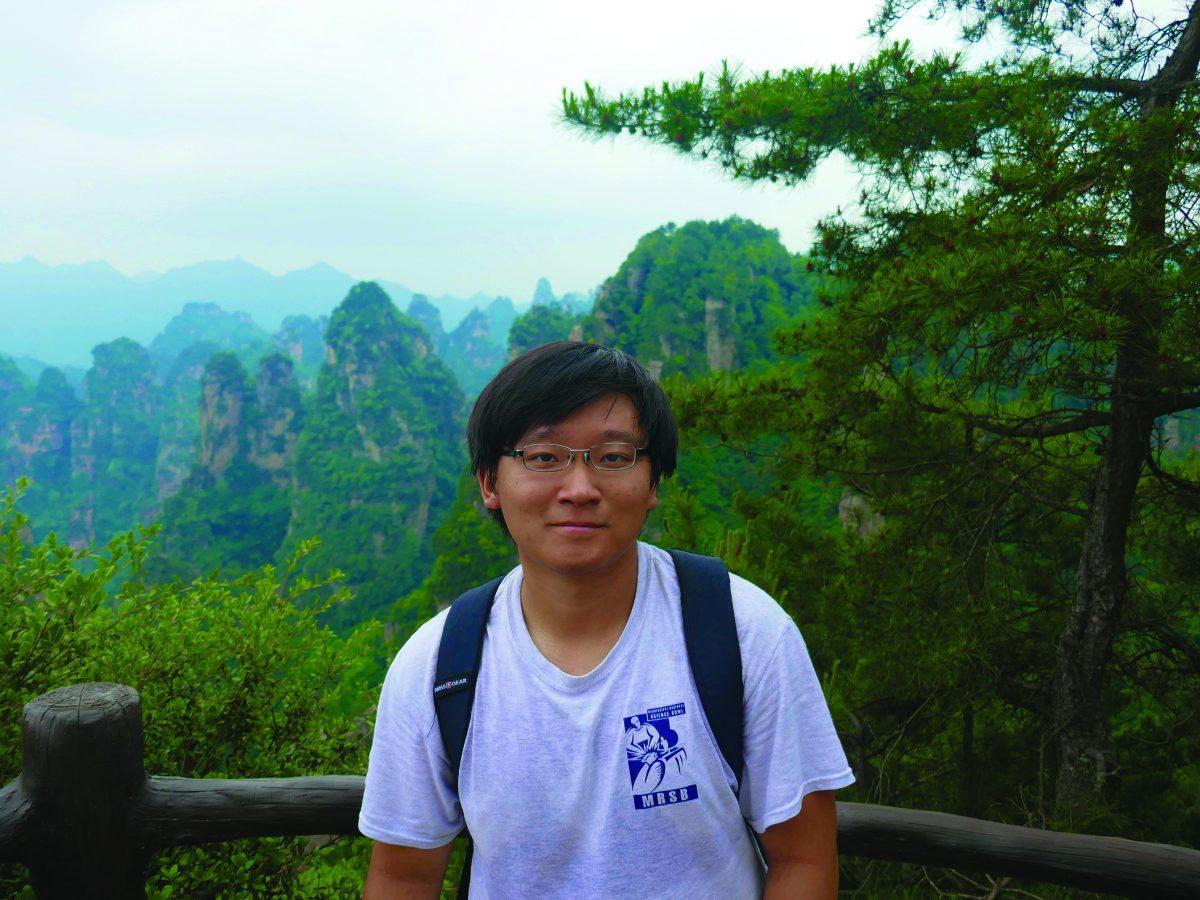

State Farm senior vice president Bob Trippel said in a press release published Feb. 14 on State Farm’s Web site that this decision was not made lightly.

“We came to this decision reluctantly. But it is no longer prudent for us to take on additional risk in a legal and business environment that is becoming more unpredictable. When there’s more certainty, we will reassess the situation,” said Trippel.

In the Feb. 16 press release, Trippel further explained the company’s actions.

“We’re not trying to pick a fight, we are simply not in a position to accept additional risk that new policies would pose in the current business and legal environment,” said Trippel.

Hood told The Associated Press that until the state Legislature can handle the issue, he has asked Gov. Haley Barbour to give an executive order forcing State Farm to keep writing new policies.

Pete Smith, spokesman for Barbour, released the response letter from Barbour to Hood regarding the matter.

The letter reads: “Thank you for your letter and request for me to order State Farm and other insurers to sell homeowners and commercial property insurance in our state. Having considered my statutory and constitutional emergency powers including the statute you cited in your letter, I have no authority to force a private company to sell its products in the State of Mississippi.”

Hood could not be reached for additional comments.

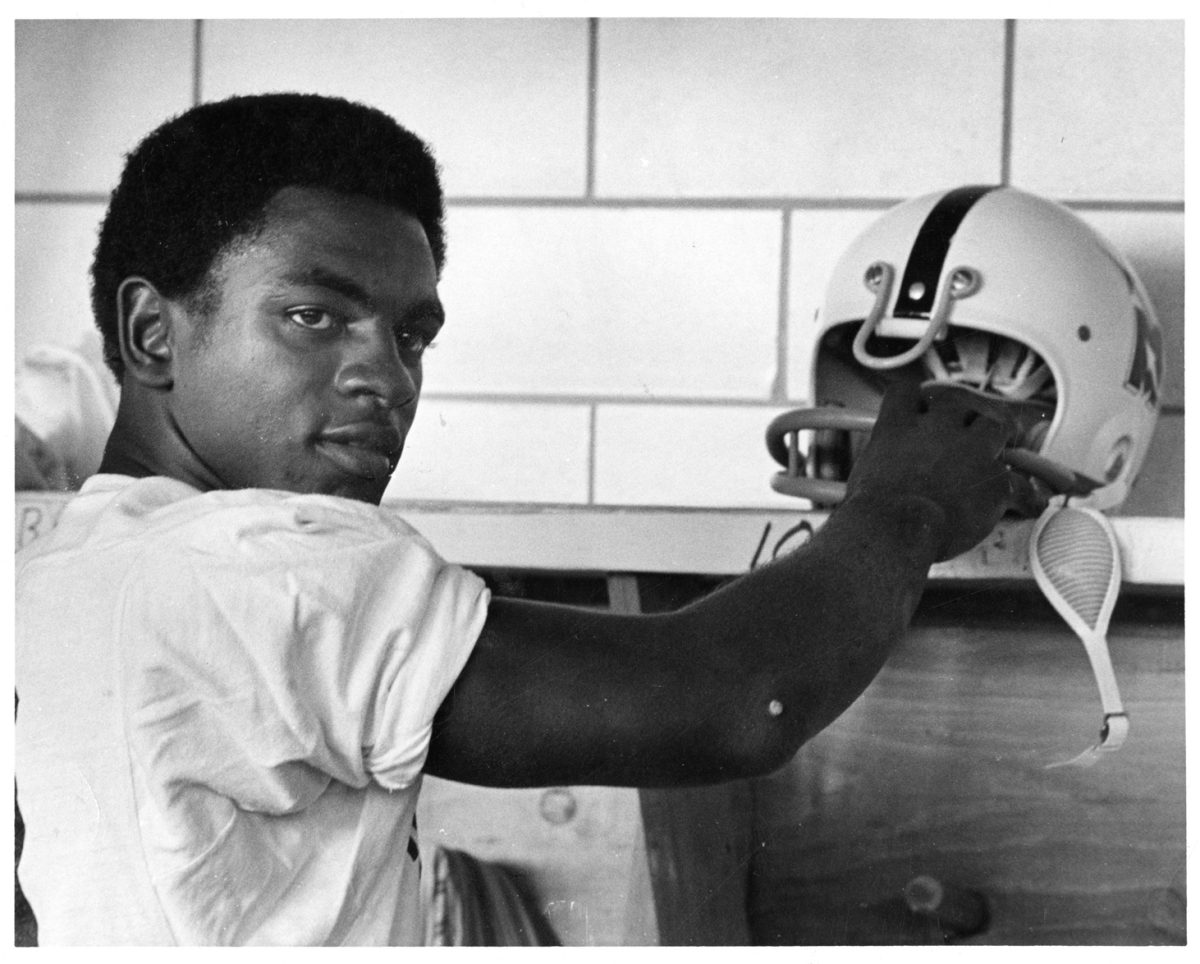

Rep. Credell Calhoun, D-Hinds, said he thinks State Farm is only hurting itself by the suspension. He said that the refusal to write new policies in Mississippi would hurt State Farm’s business all over the country, not just in the state.

“I don’t think State Farm is being fair with the people of Mississippi,” he said.

Calhoun said that no one really has any idea of the number of hurricanes and storms that will hit coastal states. Because of this, State Farm could be losing money by not insuring properties, especially during seasons with few hurricanes and storms, Calhoun said.

Insurance companies should stay through the good times as well as the bad times, even and especially after large-scale storms such as Katrina and Rita, he said.

Now, consumers would start to think of State Farm as an agency to drop at the first sign of trouble, he added.

Calhoun also said that he thinks Hood is “right on target” with his plan.

“As a government official, you should do all that you can to help the people, and I feel that General Hood is trying to do that,” he said.

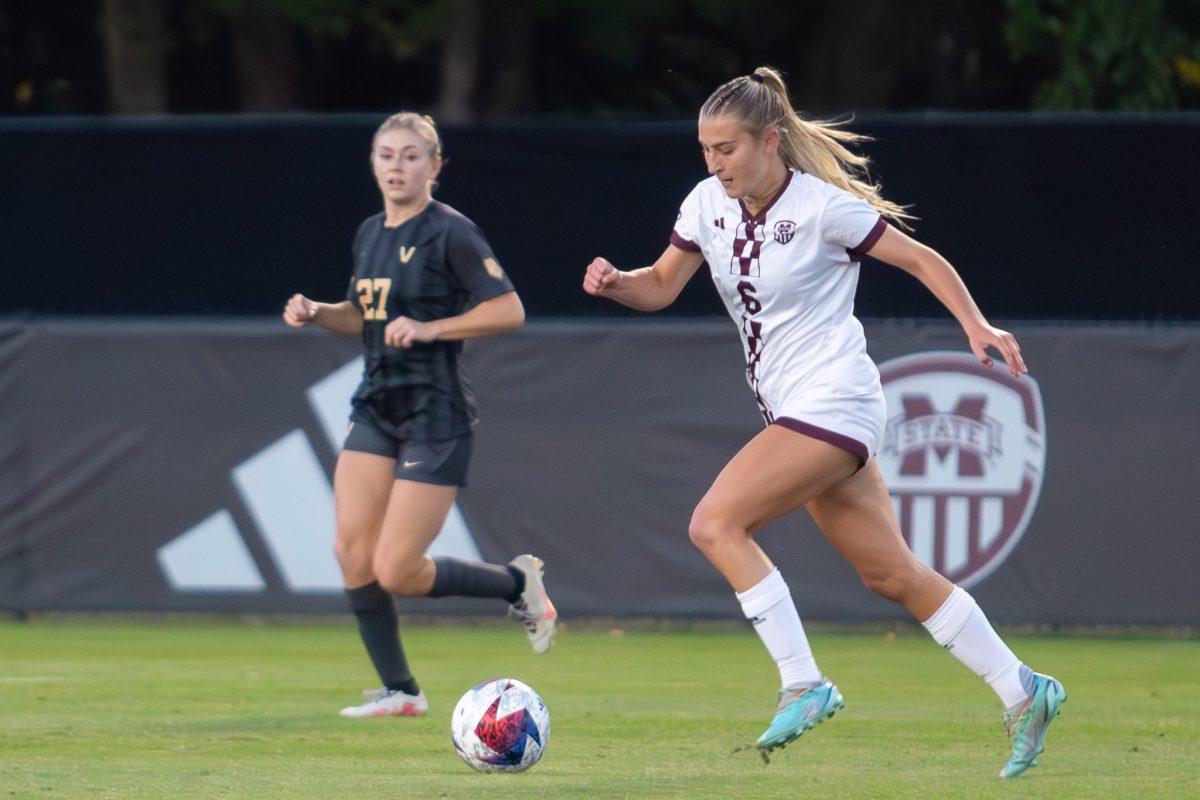

Rep. Jessica Upshaw, R-Hancock and Harrison, said she was disappointed to find out about the major insurance company’s suspension.

The legislature is working to set a safe and stable market, she said.

“We in the Mississippi Legislature are trying to come up with some legislation to benefit consumers and also provide some security to insurance companies,” she added.

Both Calhoun and Upshaw serve on the hurricane relief committee.

An article from CNN.com states that State Farm is not the only agency to cut back on policies in coastal and hurricane-affected areas.

Allstate Corporation, American International Group and Nationwide Mutual have also cut back.