When students go to the polls on Nov. 6, they will be voting for candidates for many reasons, one of which may be how they plan to address student debt.

Although the topic has not been at the forefront of their campaigns, like flashier issues such as taxes or health care, student finance and the constantly-rising costs of higher education impact millions of students.

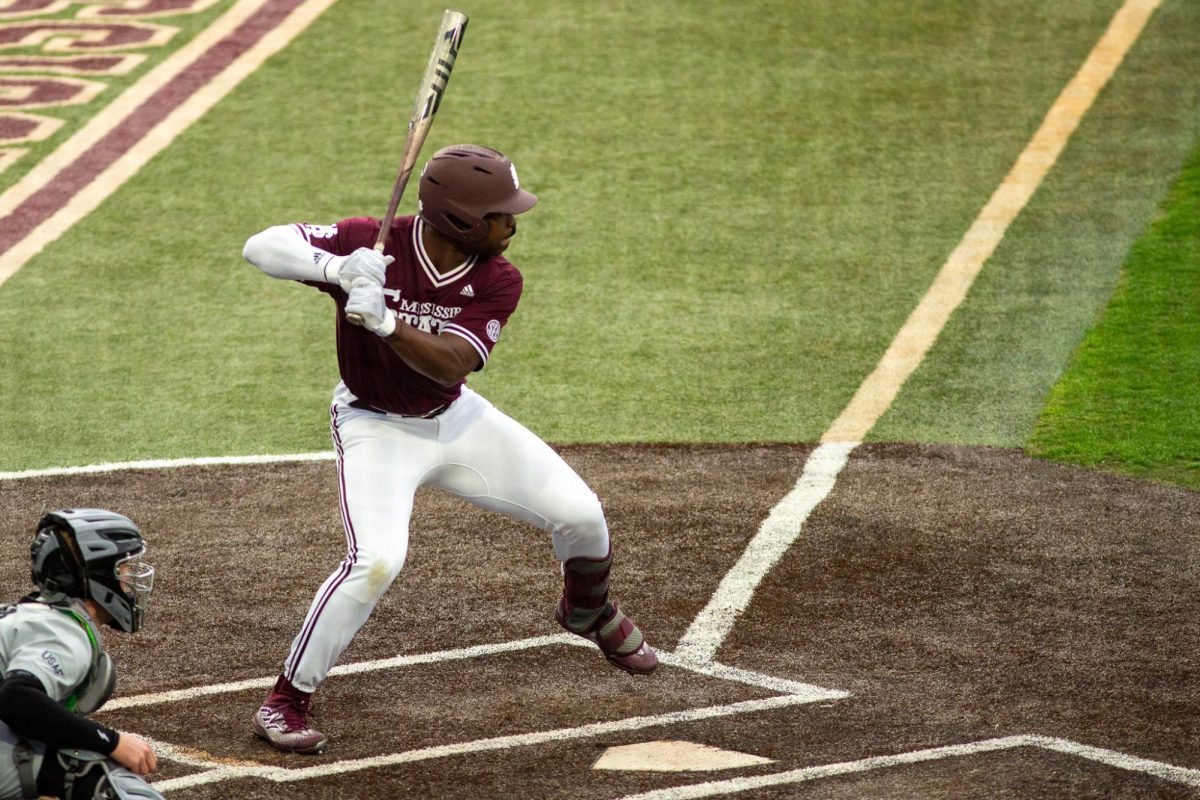

According to Mississippi State University’s Office of Institutional Research and Effectiveness, at MSU, in-state tuition rose 7.9 percent between the 2011-2012 and 2012-2013 school years, from $5,805 to $6,264.

For the four school years from 2009-2010 to 2012-2013, tuition has risen from $5,151 to $6,264, an increase of 21.6 percent.

Ten years ago, tuition was $3,874, representing a nearly 62 percent rise in costs over the past decade.

The presidential candidates have dueled over many issues during the election cycle, including reform for student finances, debt and loans.

The Romney campaign has not yet revealed details on what Mitt Romney plans to do to address student loans and debt problems, and a representative of the Mississippi Republican Party was unable to provide many details.

The Romney campaign’s website says the Republican candidate plans to “Strengthen and simplify the financial aid system, welcome private sector participation instead of pushing it away, and replace burdensome regulation with innovation and competition.”

The Obama campaign offers a detailed plan for what President Barack Obama intends to do moving forward, if reelected.

One part of the president’s plan, introduced earlier this spring, is the student loan forgiveness plan.

This would cap payments that have to be made to repay loans at 10 percent of a borrower’s income, regardless of how much money he or she makes.

Interest rates would also be limited accordingly.

Borrowers who have been repaying their loans for a minimum of 20 years would be eligible to have the outstanding balance of their loans forgiven.

This would cover up to $45,000, as long as borrowers have paid at least 10 percent of the loan’s value.

This plan is aimed primarily at federal student loans, rather than those provided through private lenders.

The president has also enacted measures to expand the availability of funding for students.

In 2010, the Student Aid and Fiscal Responsibility Act was signed into law.

It expanded the funding for Pell Grants to $36 billion, nearly double previous levels and raised the maximum Pell Grant amount from $5,350 to $5,550.

Beginning in 2014, the maximum amount for Pell Grants will be allowed to rise on a set basis to keep pace with inflation.

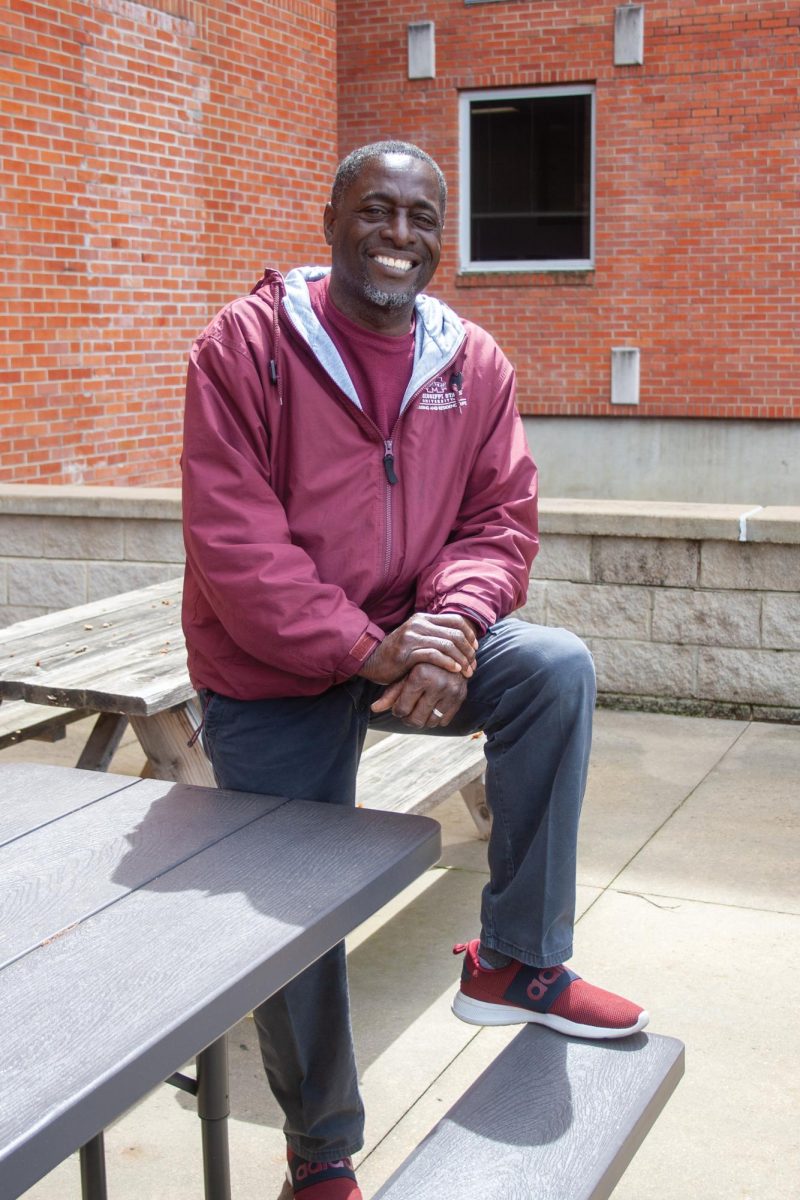

Paul McKinney, director of financial aid for MSU, said MSU has seen a large increase in the number of Pell Grant recipients since the Pell Grant expansion.

However, McKinney said a budget shortfall has held Pell Grants from expanding further and has led to changes in the system for attaining and maintaining grants.

“There are some new restrictions to make up for the shortfall,” McKinney said. “They (Pell Grants) used to be unlimited – available for as long as you were an undergrad – but now they can only be for 150 percent of your major.”

This means Pell Grants can only cover up to 150 percent of the course load for a major.

McKinney also said another change that enabled Pell Grants to be used year-round for spring, summer and fall semesters was also redacted after a year of being in effect, limiting them only covering the fall and spring semesters.

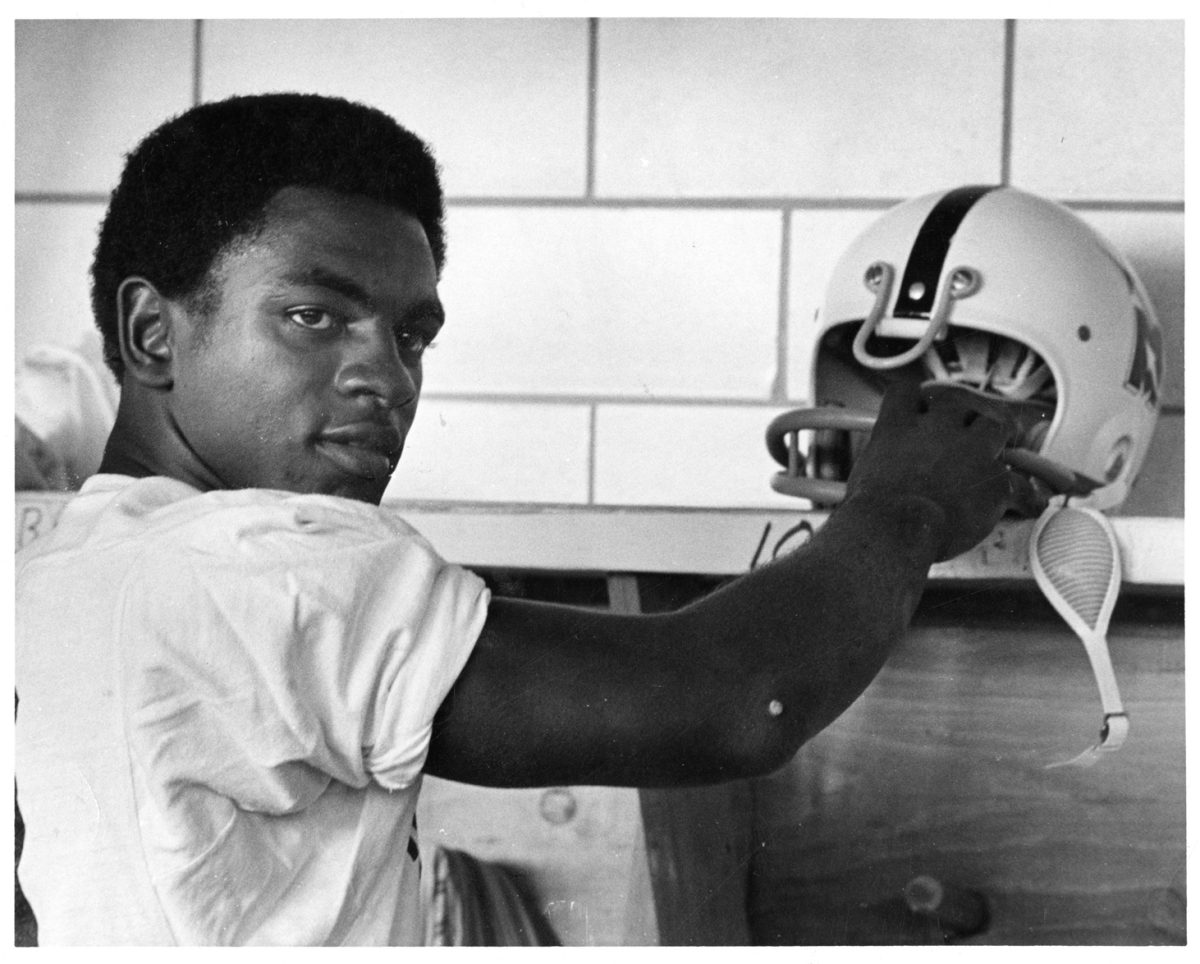

At a campaign stop in Manchester, N.H., on Aug. 13, Gov. Mitt Romney offered insight into his own plans for student finance reform.

“It is very tempting as a politician to say, ‘You know what, I will just give you some money. The government is just going to give you some money and pay back your loans for you,'” he said. “I am not going to tell you something that is not the truth, because you know, that is just taking money from your other pocket and giving it to the other pocket.”