Starkville’s 2 percent food and beverage tax, which has been in effect since June 30, 1995, will be continued for another 10 years, but this time Mississippi State University will benefit from it.

The renewal of the 2 percent tax was not voted on by the citizens of Starkville because it has been determined by the attorney general’s office that another vote was not necessary, Starkville Alderman at Large Vic Zitta said.

“The original tax was put into place with a sunset clause which said that after 10 years the tax would end and require a new referendum to be renewed for the next 10 years,” he said.

Ward 3 Alderman P.C. (Mac) McLaurin Jr. said he did not think the attorney general’s decision would upset Starkville voters.

“It is possible that a small number might have preferred an election, but there is wide support for the 2 percent food and beverage tax because the benefits for the city, the university and the county are of major importance,” McLaurin said.

For the next 10 years, MSU will receive 20 percent of the revenue from the 2 percent tax Student Association president Adam Telle said.

The amount MSU will receive comes to about $200,000 a year, he said.

Telle said he and Vice President of Student Affairs Bill Kibler would develop a budget for what the money will go toward.

“The money must be used specifically for activities that are beneficial to students,” he said.

In addition to the 20 percent given to MSU, the new breakdown also allots 40 percent to the Starkville Parks and Recreation Commission, ten percent to the city for economic development related infrastructure, 25 percent to the Oktibbeha County Economic Development Authority and 15 percent to the Starkville Visitors and Convention Bureau, Zitta said.

For the last ten years, 40 percent of the revenue went to the Starkville Parks and Recreation Commission and 60 percent was split evenly between the economic development groups.

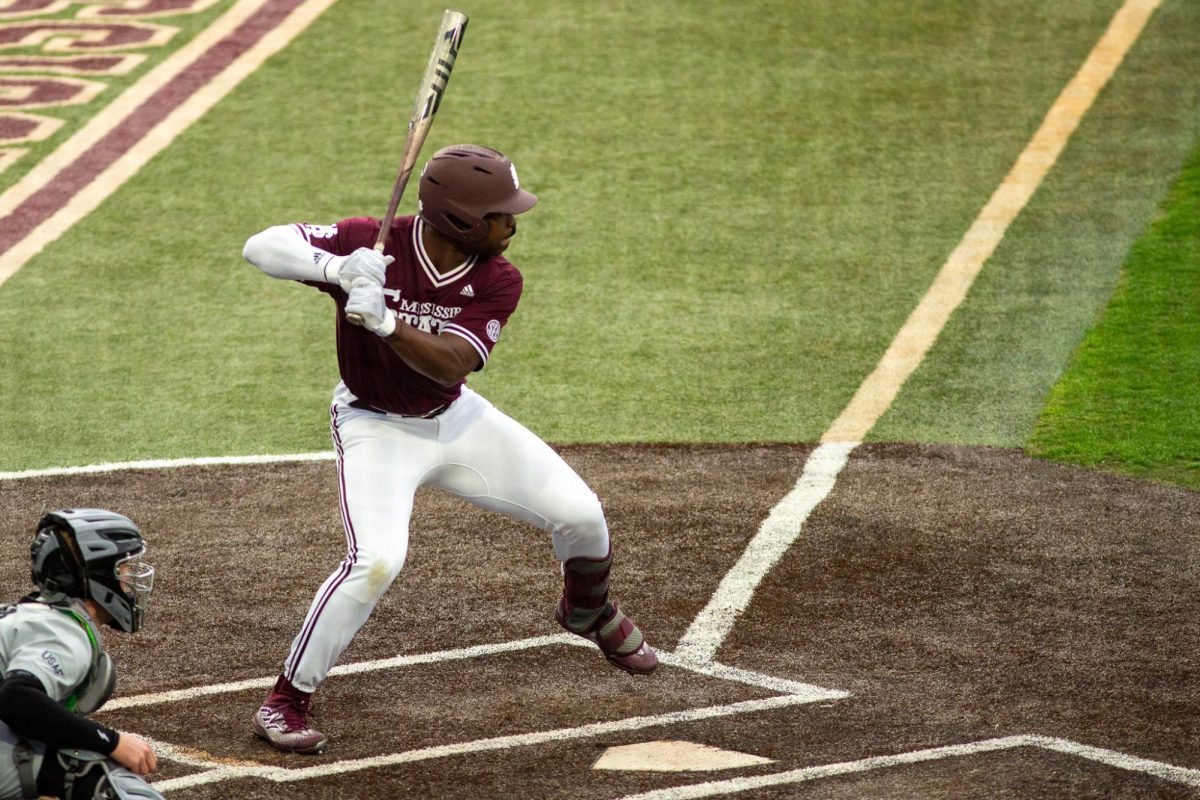

MSU received no benefits from the 2 percent for its first ten years in effect, though MSU contributes greatly to the economy of Starkville. Overall, Starkville will benefit from giving part of the tax revenue to MSU through higher income from students, Telle said.

“I think this money being given to the university is going to create a happier student who will be more likely to stay on the weekends and more likely to return next year,” Telle said.

“I think it will benefit all who are involved. We want to put the money into activities that will increase the revenue from the 2 percent tax by bringing people in the Starkville with attractions like concerts and speakers.”

Students to benefit from 2 percent tax

Donate to The Reflector

Your donation will support the student journalists of Mississippi State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.