According to James E. Bauer, a deputy assistant director in the U.S. Secret Service Office of Investigations, identity theft is the fastest growing crime in America, affecting 900,000 new victims a year. Identity theft occurs when someone wrongfully uses another person’s identification to obtain credit, loans, money, services, or other goods in that person’s name. An identity thief may even commit crimes while impersonating another person.

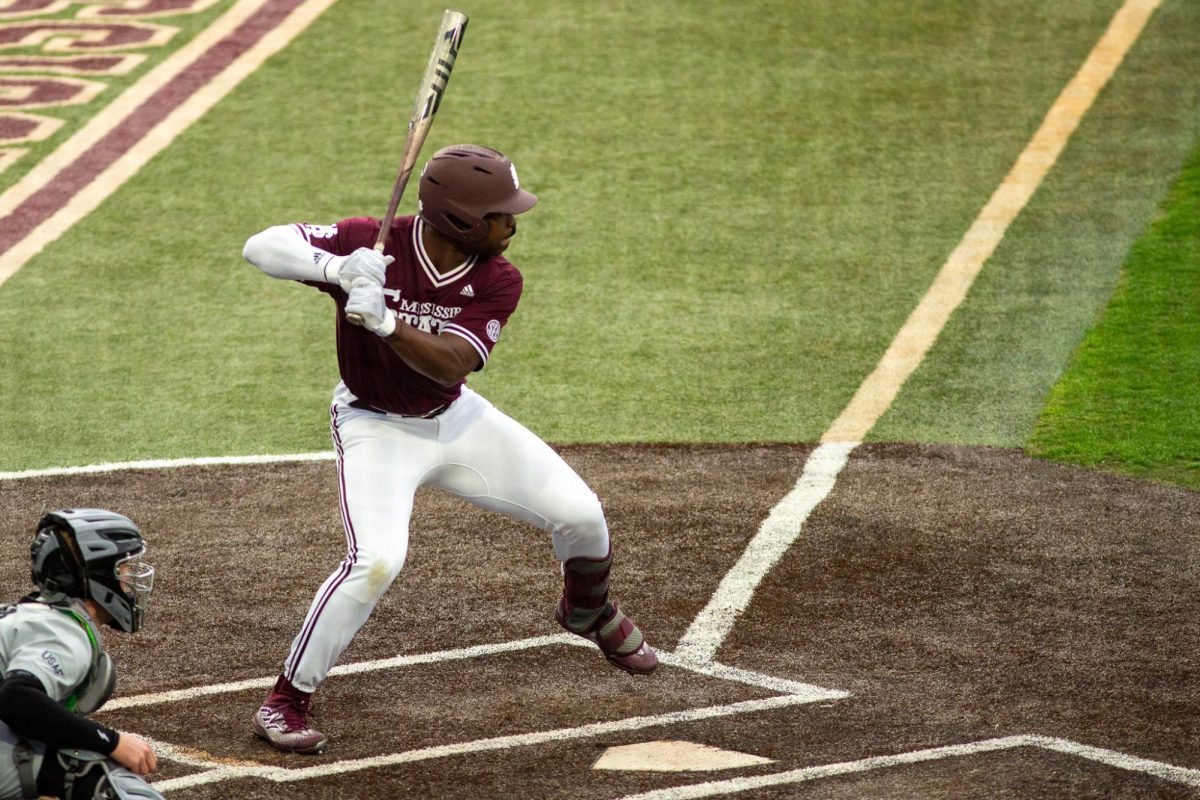

Thomas Bourgeois, assistant dean of students at Mississippi State University, said there are generally two or three cases of identity theft a year at Mississippi State.

In one case he mentioned, a student took their roommates social security number and credit card number and ran up thousands of dollars in debt.

He related another incident in which a student used their roommate’s social security number to get credit to buy a Gateway computer.

“This sort of thing is one of the reasons why we now have the three letters and a number on student ID’s instead of the social security number,” Bourgeois said.

Bourgeois also said he would like to remind students to take precautions against identity theft and other types of crime that can take place on college campuses.

“According to last year’s victim assessment, 80 percent of campus crime could have been prevented by simple precautions,” he said.

Among these precautions, he listed locking cars and dorm rooms, not leaving identification with one’s social security number lying around and not leaving valuables such as CD players and cell phones in plain sight even in a locked car. He also mentioned not leaving bags unattended, as this could allow someone to steal one’s books.

“Book theft happens and could easily be prevented,” he said. “On the other end, we’re very vigilant to catch book thieves when they’re trying to sell them back,” Bourgeois said.

“Overall, I think we have a very safe campus-safer than a lot of places,” he said. “But we shouldn’t be lulled into a false sense of security by that. It’s not that we don’t want people to trust each other, but they should be aware that things like this do happen.”

Bourgeois also provided a list of helpful tips to prevent identity theft, found online at http://www.identitytheft.org. These tips were compiled by Mari Frank, a California attorney and author of “From Victim to Victor.”

Tips for college students

– Buy a cross-cut type shredder Shred all your important papers and especially pre-approved credit applications received in your name and other financial information that provides access to your private information. Don’t forget to shred your credit card receipts.

– Be careful at ATMs and when using phone cards. “Shoulder surfers” can get your ‘pin number’ and get access to your accounts.

– Do not put checks in the mail from your home mailbox. Drop them off at a U.S. Mailbox or the Post Office. Mail theft is common. It’s easy to change the name of the recipient on a check with an acid wash.

– Cancel all credit cards that you do not use or have not used in 6 months.

– Put passwords on all your accounts and do not use your mother’s maiden name. Make up a fictitious word.

– Take your name off of all promotion lists.

– Empty your wallet of all extra credit cards and social security numbers, etc. Do not carry any identifiers you do not need. Don’t carry your birth certificate, social security card, or passport, unless necessary.

– Do not put your credit card account number on the Internet (unless it is encrypted on a secured site.) Don’t put account numbers on the outside of envelopes, or on your checks.

– Immediately correct all mistakes on your credit reports in writing. Send those letters Return Receipt Requested, and identify the problems item by item with a copy of the credit report back to the credit reporting agency.

Credit card fraud can affect students

Donate to The Reflector

Your donation will support the student journalists of Mississippi State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.