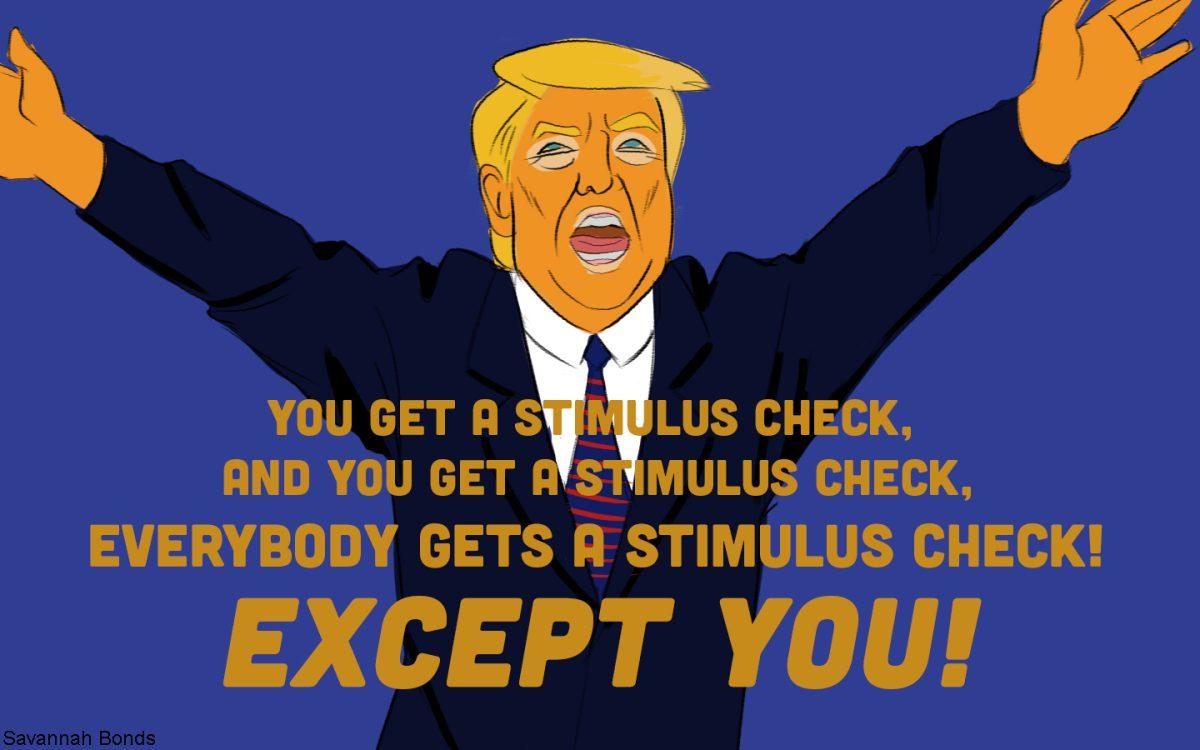

In March, the Trump administration signed the Coronavirus Aid, Relief and Economic Security Act, or the CARES Act, into law. This act offered a $2 trillion stimulus package designated for taxpayers and small businesses that have been economically impacted by the arrival of COVID-19. However, as stated by Hao Liu of Fortune News, while parents with children 16 years of age and under are eligible for an additional $500 per child, anyone aged 17 to 24 and filed as a dependent on their parents’ taxes does not qualify for stimulus funds.

This category mostly consists of college students who have their own financial struggles, and it leaves us students in an uncertain state within a society which apparently considers us neither children nor adults. As someone who is a dependent but has been paying and filing taxes for the last five years, I argue not initially offering the $500 credit for all dependents or granting the full $1200 to taxpaying dependents excludes vital members of our society whose finances have been strained by COVID-19.

College students were greatly impacted by the arrival of COVID-19, as many lost their on-campus jobs and housing when classes moved online and did not have a stable home or income to return to. Additionally, many college students face a substantial amount of student loan debt and actively work on-campus jobs in order to pay off these loans.

Also, the CARES Act seems to specifically exclude certain dependents. According to Mark Kantrowitz of Forbes, “the eligibility criteria are based on whether the student is claimable as a dependent, not whether they are claimed as a dependent.”

Therefore, even if a college student is not filed as financially dependent upon their parents, they are still ineligible for the stimulus checks.

While the CARES Act did grant some emergency financial aid to college students and offered a payment pause and interest waiver for federal student loans, the grants were allocated only to students who could provide proof of extreme financial need, not even among themselves but among their parents, and those with private student loans may not be awarded a payment pause or interest waiver. This is problematic because countless college students are financially responsible for themselves and may not even be claimed as dependents; the idea they can only receive aid if their parents need it still excludes many students who provide for themselves and pay private loans.

Although college students were mostly left out of the stimulus checks, I must admit the new Higher Education Emergency Relief Fund coupled with the CARES Act greatly made up for the lack of stimulus checks among college students and dependents.

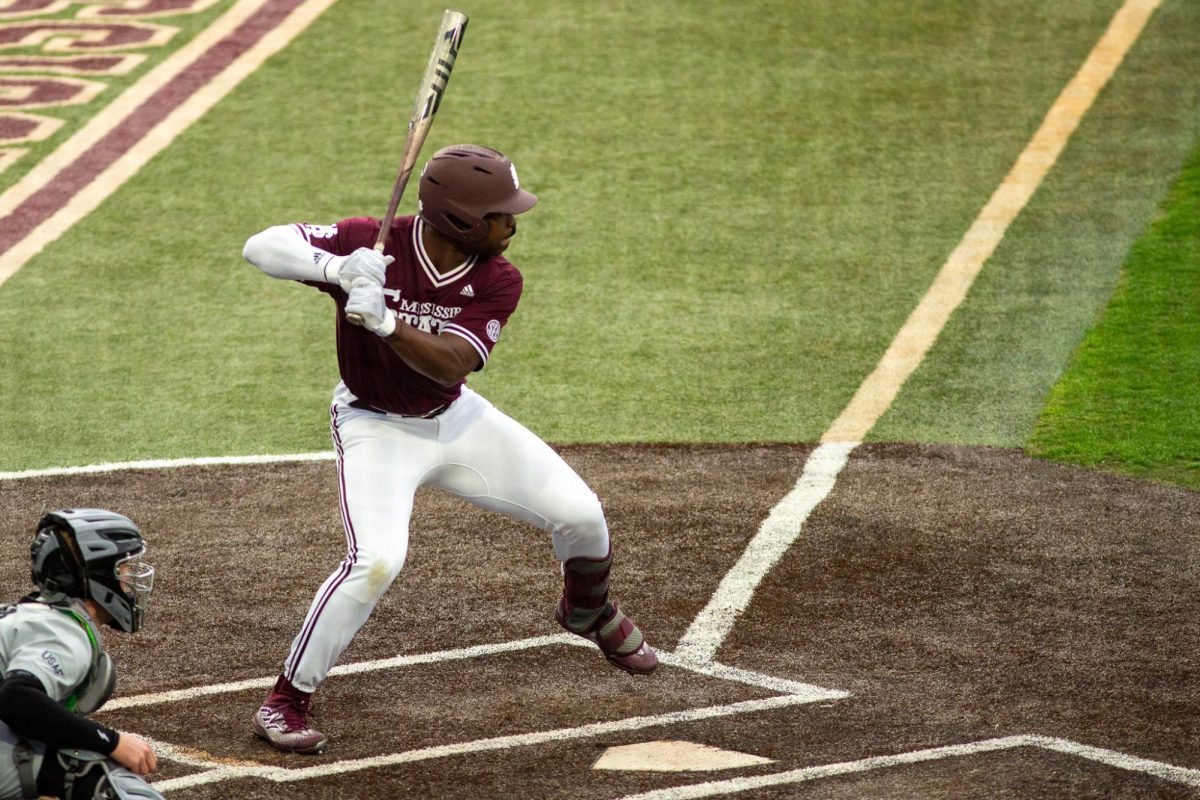

According to the National Association of Student Financial Aid Administrations, the Higher Education Emergency Relief Fund provides over $14 billion in emergency funding to higher education. Within those funds, more than $6 billion are granted directly to students in the form of emergency financial aid grants as compensation for expenses related to the COVID-19 crisis. This allowed for Mississippi State University to grant $500-$600, depending on eligibility and need, to students who certify they incurred expenses related to the disruption of campus operations due to COVID-19. After not receiving the first round of stimulus checks, this proved to be very beneficial to me, personally, and to many other college students who faced financial hardships due to the strain which COVID-19 has placed on our economy.

While the Higher Education Emergency Relief Fund is greatly appreciated among many, I worry dependents ages 17 to 24 will be left out in further stimulus packages and are only considered if enrolled in a form of higher education. With these uncertain times, dependents ages 17 to 24 require aid just like any other citizen whether or not they decide to continue their higher education, which is highly questionable during these times of financial instability. As this pandemic continues, I hope the Trump administration continues to consider dependents ages 17 to 24, so we may still receive aid as the rest of the nation does, regardless of our enrollment in a higher education.