Earlier this month it was revealed President Donald Trump had brokered a deal with Democratic leaders, Nancy Pelosi and Chuck Schumer, to suspend the debt ceiling–funding the government for the next three months.

According to Bob Bryan at Business Insider, the bill passed in the House by a 316-90 vote, with most of the opposition coming from Republicans.

While it is good we will not have to worry about a government shutdown for the next few months, this deal ultimately showed us why Congress should permanently repeal the debt ceiling.

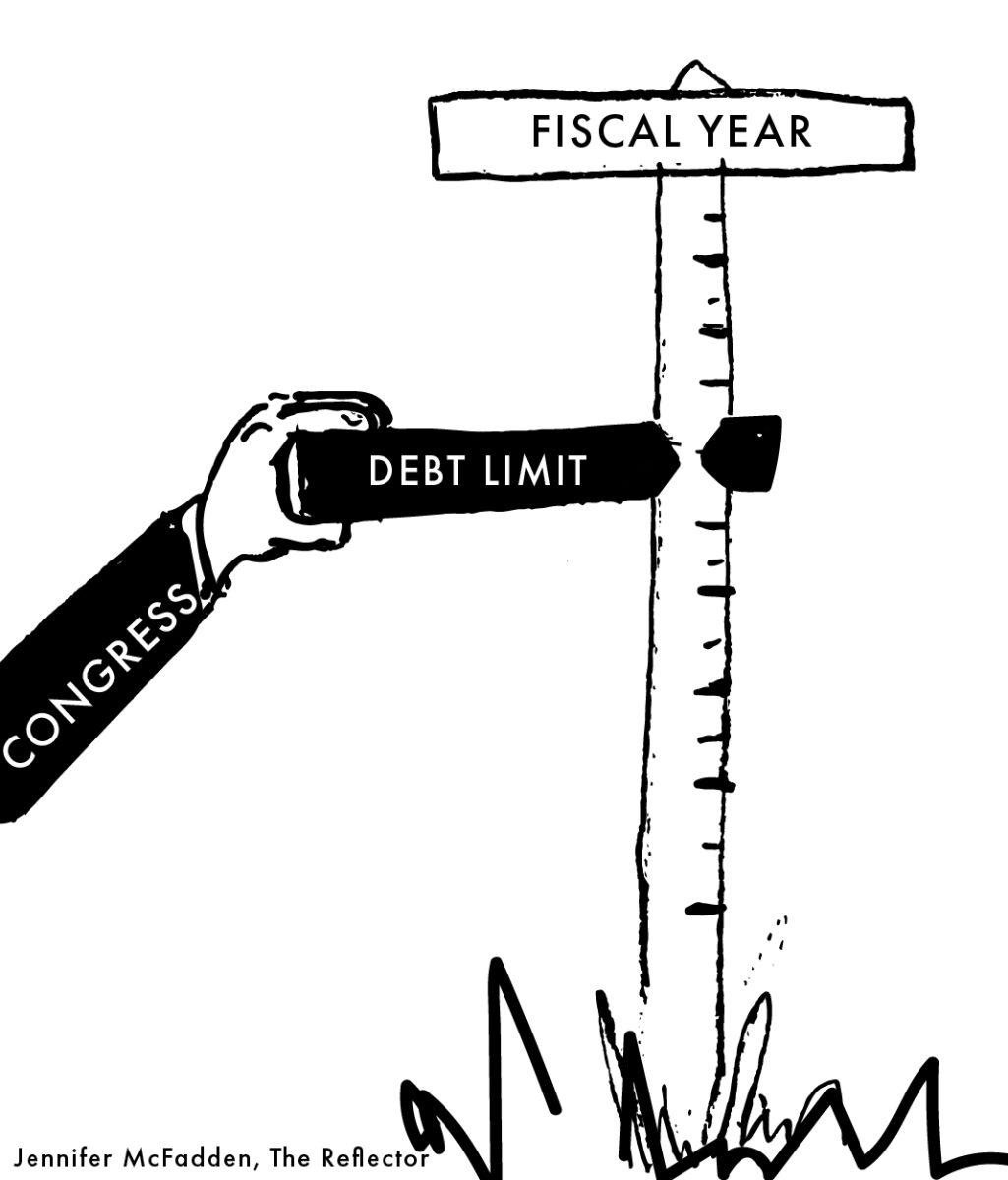

Even though buzzwords such as “fiscal cliff” often get thrown around in the news during these negotiations, a lot of people are not familiar with the details of our debt ceiling. Basically, since the U.S. government makes appropriation decisions the year before they are put into place, lawmakers do not know the exact amount of revenue they will have access to for the calendar year.

Around the middle of the year, it becomes clear the government will not have the money to cover all their obligations. This problem is alleviated when the Treasury Department borrows money to cover the outstanding costs, which is where our national debt originates.

The debt ceiling was created to limit how much the U.S. could borrow to cover their debt, although it is ultimately artificial—Congress can simply raise or suspend the limit whenever they want.

While this process may seem fairly benign, for the past few years the threat of defaulting on the debt has been weaponized by members of Congress. They have done this in order to force their opponents to negotiate over spending issues.

Over the years, this has only led to unnecessary tension in Washington. Defaulting on our debt is one of the most economically catastrophic decisions our leaders can make.

According to Jason Furman and Rohit Kumar of the Wall Street Journal, if lawmakers decided to default, Washington would either stop paying bondholders or they would simply choose not to meet all of their obligations.

This could include cutting anything from payments for disabled veterans or for defense contractors. In either scenario, our leaders would be making a ridiculously irresponsible decision, especially since the U.S. has never defaulted on our entire debt.

It is almost impossible to predict the repercussions of a U.S. default, but I am willing to estimate it would be at least as bad as the housing crisis of 2007-2008.

However, it could be far worse. The fact some of our representatives have flirted with this idea is mind-boggling, and clearly indicates this power should be removed from the table.

If Congress were to permanently repeal the debt ceiling, it would give our Treasury Department the freedom to more efficiently handle the government’s debt payments without having to worry about interference from political actors.

In general, it is more costly for the Treasury to make payments when the debt ceiling is approaching, which means it costs taxpayers money before the limit is even reached. It would also decrease market volatility, and combat the lowered consumer confidence resulting from approaching the debt ceiling.

Of course, there are Republicans who say eliminating the debt limit would be antithetical to their fiscally conservative values.

According to Burgess Everett and Josh Dawsey for Politico, members of the Freedom Caucus were promising a robust fight over the debt ceiling come December. Some senators, such as John Cornyn of Texas, were adamant they did not wish to pursue removing the debt limit.

While there is nothing wrong with being concerned about the U.S. national debt, this is not the time to do something about it. The time to embrace fiscal conservatism and budget-trimming is during the appropriations phase in the prior year, not when the country is staring down a potential default.

Now, the government has made their commitments and must follow through. Otherwise, they will destroy the trust they have built up over the past few centuries.

If Congress wants to take a serious step towards making debt limit negotiations less tumultuous, they should pass legislation removing the ceiling before we find ourselves staring again at the precipice of a U.S. default.

Congress needs to repeal the U.S. debt limit

Donate to The Reflector

Your donation will support the student journalists of Mississippi State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.