A judge April 11 refused to prevent Mississippi Attorney General Jim Hood from reviewing documents that could link State Farm Insurance Co. with fraudulent activity in the wake of Hurricane Katrina.

The state’s leading insurance provider is required by law to turn over any and all paperwork to Hood and his investigators.

“I want to reassure Mississippians who have already been victimized by Katrina that I am doing everything I can to keep them from being victimized again by the insurance companies,” Hood said in a news release.

State Farm representatives had tried to keep Hood from being able to access the documents because he’s involved in two separate lawsuits with the nationwide provider. Attorneys for one of the nation’s largest insurance providers cited the attorney general had a “conflict of interest” because of his involvement in two different cases.

Hood’s investigation has brought serious allegations against State Farm, with the largest claiming that the insurance provider manipulated engineering reports to keep from paying thousands of Gulf Coast residents’ property claims. This is the basis for Hood’s criminal suit.

State Farm spokesman Frazer Engermen says that such claims against the company are absurd.

“Any suggestion that we are conducting ourselves in an inappropriate and unethical manner is simply wrong,” Engermen said. “When we use these outside firms to seek an opinion, we expect an objective opinion based on the facts.”

Engermen said State Farm asked for assistance in Mississippi from qualified engineering firms, and those firms’ opinions make up a small portion of the total claims submitted.

“We’ve asked for assistance from engineering firms in less than 2 percent of the 84,000 claims submitted,” he said.

Based on the statistics provided by Engermen, that translates into fewer than 1,700 claims. The average claim filed by Katrina residents on the Gulf Coast weighs in at over $20,000. according to the Mississippi Insurance Department website. Hypothetically speaking, if the insurance provider had falsified all of the claims investigated by the engineering firms, State Farm could have saved an estimated $36 million in unsubstantiated claims.

The civil suit addresses a crucial issue with the hurricane coverage offered by State Farm and other insurance companies.

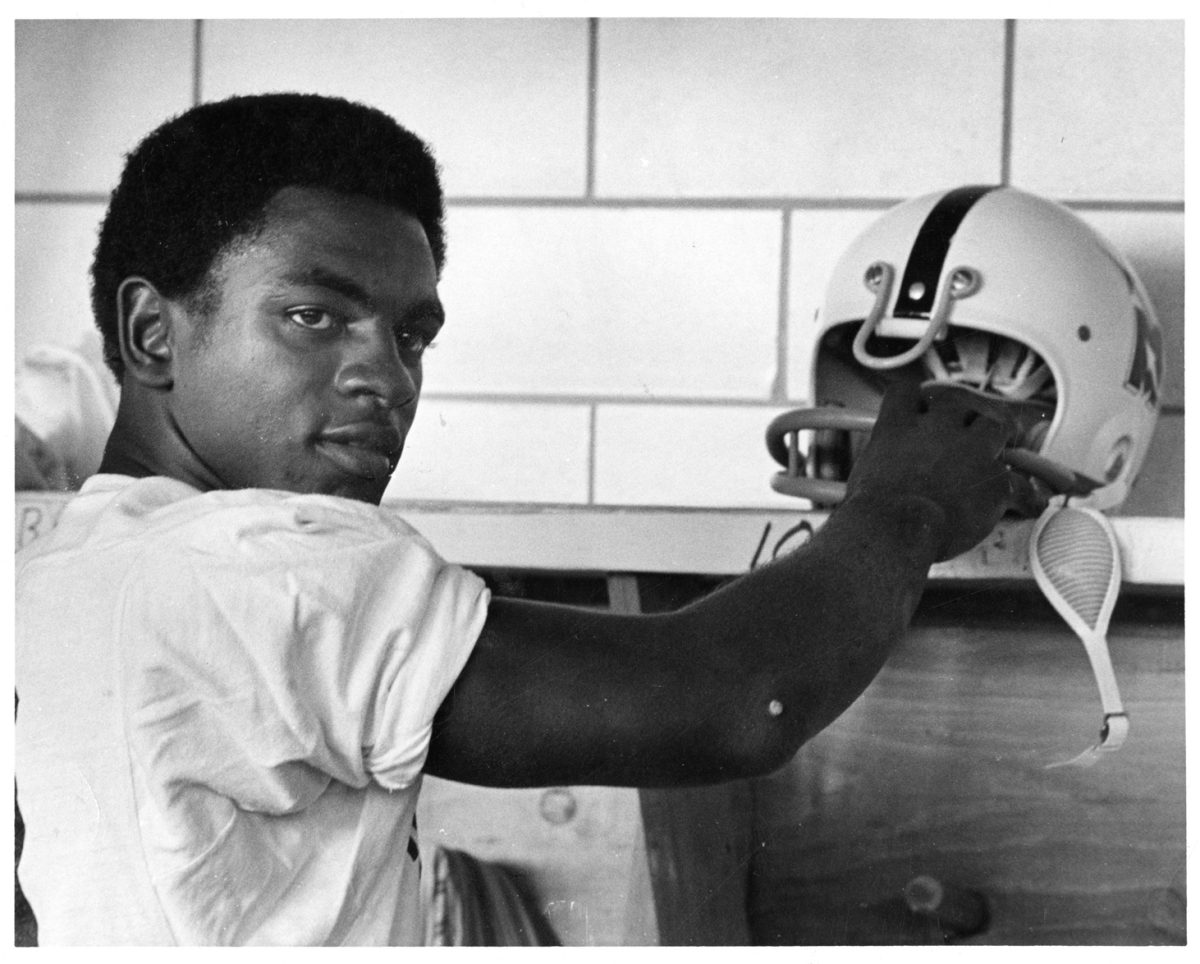

Insurance chair and professor of finance Ed Duett said the civil suit represents a very emotional one.

“There’s lots of emotional issues for Mississippi residents and for many of our coast students,” Duett said. “But public officials trying to force companies into doing something they were not paid to do is another issue.”

The providers assert their coverage does not include rising water damage to insured homes. Wind-driven water, commonly known as a storm surge, is also not covered.

Hood wants a waiver added to future insurance forms that would tell consumers what the coverage doesn’t include.

Duett said other steps are also being made to give residents on the coast a forum to voice their opinions.

“The Commissioner of Insurance, George Dale, has brought in a mediation group to mediate issues between homeowners and insurance companies. That information is available at no cost to the homeowner,” he said.

Hood has also met with speculation from groups who believe his motivation arises out of running for re-election next year..

“I don’t believe Hood will get any campaign contributions from insurance companies,” Duett said.

Hood gains access to State Farm documents

Donate to The Reflector

Your donation will support the student journalists of Mississippi State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.