In an era where social media platforms like TikTok and Instagram dominate our daily lives, the art of saving and budgeting seems to be fading into obscurity. The relentless push for consumerism, amplified by these platforms, has led to a culture where materialism is not only normalized but celebrated.

Social media has evolved from a space for connection to a bustling marketplace. Features like TikTok Shop and Instagram’s shopping capabilities have transformed these platforms into seamless shopping experiences. TikTok Shop, for instance, has seen remarkable success, especially during the 2024 holiday season, where it achieved $100 million in single-day sales on Black Friday according to Business Insider. This surge is attributed to influencer marketing and livestream shopping sessions, which have become integral to the app.

Instagram, too, has capitalized on this trend by integrating shopping features that allow users to purchase products directly through the app. This seamless integration blurs the lines between social interaction and consumerism, making it easier for users to succumb to impulsive buying behaviors.

A significant part of this phenomenon is the sheer volume of advertisements users are exposed to daily. On TikTok, it is nearly impossible to scroll through two videos without encountering an ad or an influencer promoting a product for commission. The TikTok algorithm is designed to seamlessly blend organic content with promotional material, making it difficult for users to distinguish between genuine recommendations and paid endorsements.

Similarly, Instagram’s main feed and stories have seen an overwhelming increase in advertisements, with sponsored posts appearing almost as frequently as organic content. This saturation of advertisements reinforces the culture of constant consumption, making it harder for individuals to resist the temptation.

The influence of these platforms on consumer behavior is significant. A study from the International Council of Shopping Centers highlighted that 45% of Gen Z respondents identified TikTok and Instagram as the top platforms influencing their purchasing decisions. This statistic underscores the power these platforms wield over younger generations, who are more susceptible to the allure of curated lifestyles and products showcased by influencers.

Caitlin Perkins, a junior secondary education major at Mississippi State University, explained that these platforms and their persistent advertisements have made saving and budgeting significantly harder for her.

“I absolutely think that social media makes it harder to budget. There are so many ads or even just influencers that have certain things, and it makes you want to buy them. But I think they’re honestly so annoying,” Perkins said. “Half the time they lie and just use their video to clickbait you.”

A particularly interesting trend on TikTok is the rise of the “consumerism final boss” phenomenon. This trend features influencers showcasing their extravagant purchases, often with the goal of outdoing previous viral shopping hauls. Whether it is an entire closet of designer handbags, a room full of PR packages, or an excessive amount of beauty products, these videos glamorize over-the-top spending.

The term “final boss” implies that these influencers have reached the peak of consumerism, setting unrealistic expectations for their followers and further driving impulsive purchasing behavior. This trend not only glorifies excess but also fuels the idea that financial well-being is secondary to having the latest trending products.

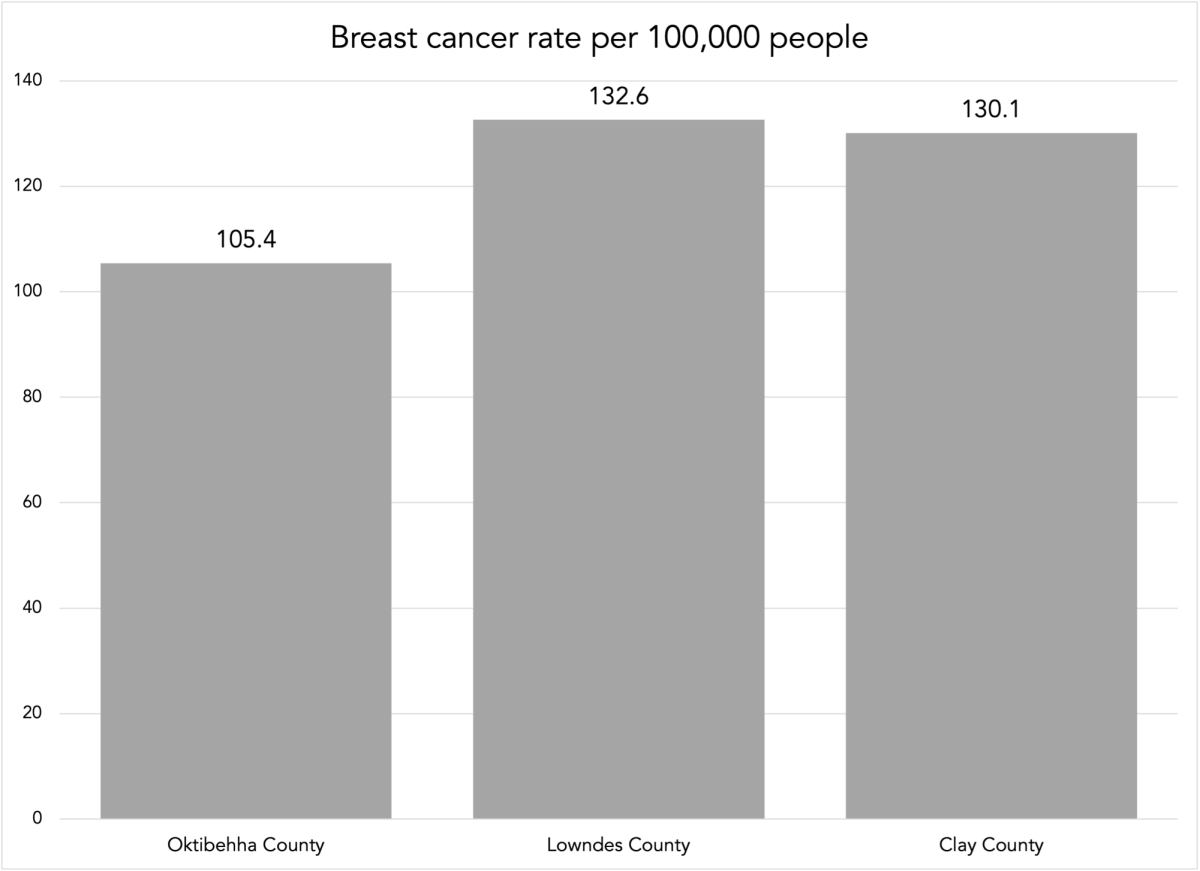

This shift towards materialism is not without consequences. The personal saving rate in the United States has seen a significant decline. In December 2024, the personal saving rate stood at 3.8%, according to the Federal Reserve Bank of St. Louis, a stark contrast to the higher rates observed in previous decades.

This downward trend indicates that Americans are saving less, potentially jeopardizing their financial security in the long run.

The glorification of online shopping and the constant bombardment of targeted advertisements contribute to a culture where spending is encouraged, and saving is an afterthought. The convenience of one-click purchases and the dopamine rush associated with acquiring new items make it challenging for individuals to resist the temptations presented by these platforms.

The consequences of this materialistic mindset are palpable. On an individual level, the emphasis on acquiring goods can lead to financial strain, increased debt and a diminished capacity to handle unforeseen expenses.

While social media platforms have revolutionized the way we connect and interact, they have also ushered in an era where consumerism is deeply ingrained in our daily experiences, and they have made it harder to balance the conveniences of modern technology with financial prudence.