Current estimates put U.S. health care spending at approximately 16% of GDP, second only to East Timor (Timor-Leste) among all United Nations member nations.[7] The health share of GDP is expected to continue its historical upward trend, reaching 19.5 percent of GDP by 2017.[33][34] Of each dollar spent on health care in the United States 31% goes to hospital care, 21% goes to physician services, 10% to pharmaceuticals, 8% to nursing homes, 7% to administrative costs, and 23% to all other categories (diagnostic laboratory services, pharmacies, medical device manufacturers, etc.[23]

The Office of the Actuary (OACT) of the Centers for Medicare and Medicaid Services publishes data on total health care spending in the United States, including both historical levels and future projections.[35] In 2007, the U.S. spent $2.26 trillion on health care, or $7,439 per person, up from $2.1 trillion, or $7,026 per capita, the previous year.[36] Spending in 2006 represented 16% of GDP, an increase of 6.7% over 2004 spending. Growth in spending is projected to average 6.7% annually over the period 2007 through 2017. Health insurance costs are rising faster than wages or inflation, and medical causes were cited by about half of bankruptcy filers in the United States in 2001.[37]

The Congressional Budget Office has found that “about half of all growth in health care spending in the past several decades was associated with changes in medical care made possible by advances in technology.” Other factors included higher income levels, changes in insurance coverage, and rising prices.[38] Hospitals and physician spending take the largest share of the health care dollar, while prescription drugs take about 10 percent.[39] The use of prescription drugs is increasing among adults who have drug coverage.[40]

One analysis of international spending levels in the year 2000 found that while the U.S. spends more on health care than other countries in the Organisation for Economic Co-operation and Development (OECD), the use of health care services in the U.S. is below the OECD median by most measures. The authors of the study concluded that the prices paid for health care services are much higher in the U.S.[41]

Health care spending in the United States is concentrated. An analysis of the 1996 Medical Expenditure Panel Survey found that the 1% of the population with the highest spending accounted for 27% of aggregate health care spending. The highest-spending 5% of the population accounted for more than half of all spending. These patterns were stable through the 1970s and 1980s, and some data suggest that they may have been typical of the mid-to-early 20th century as well.[42][43] One study by the Agency for Healthcare Research and Quality (AHRQ) found significant persistence in the level of health care spending from year to year. Of the 1% of the population with the highest health care spending in 2002, 24.3% maintained their ranking in the top 1% in 2003. Of the 5% with the highest spending in 2002, 34% maintained that ranking in 2003. Individuals over age 45 were disproportionately represented among those who were in the top decile of spending for both years.[44]

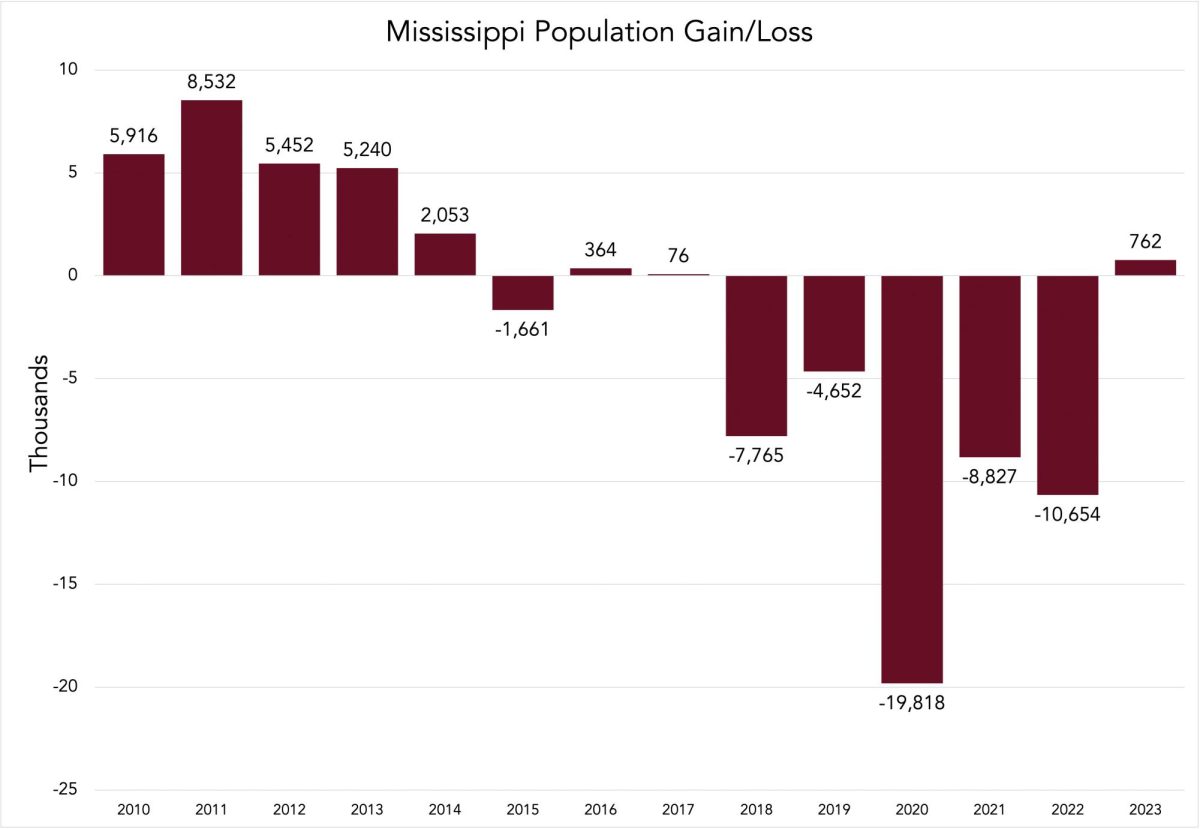

Health care cost rise based on total expenditure on health as % of GDP. Countries are USA, Germany, Austria, Switzerland, United Kingdom and Canada.

Seniors spend, on average, far more on health care costs than either working-age adults or children. The pattern of spending by age was stable for most ages from 1987 through 2004, with the exception of spending for seniors age 85 and over. Spending for this group grew less rapidly than that of other groups over this period.[45]

The 2008 edition of the Dartmouth Atlas of Health Care[46] found that providing Medicare beneficiaries with severe chronic illnesses with more intense health care in the last two years of life-increased spending, more tests, more procedures and longer hospital stays-is not associated with better patient outcomes. There are significant geographic variations in the level of care provided to chronically ill patients. Only a small portion of these spending differences (4%) is explained by differences in the number of severely ill people in an area; rather, most of the differences are explained by differences in the amount of “supply-sensitive” care available in an area. Acute hospital care accounts for over half (55%) of the spending for Medicare beneficiaries in the last two years of life, and differences in the volume of services provided is more significant than differences in price. The researchers found no evidence of “substitution” of care, where increased use of hospital care would reduce outpatient spending (or vice versa).[46][47]

Increased spending on disease prevention is often suggested as a way of reducing health care spending.[48] Research suggests, however, that in most cases prevention does not produce significant long-term costs savings.[48] Preventive care is typically provided to many people who would never become ill, and for those who would have become ill is partially offset by the health care costs during additional years of life.[48]

In September 2008 The Wall Street Journal reported that consumers were reducing their health care spending in response to the current economic slow-down. Both the number of prescriptions filled and the number of office visits dropped between 2007 and 2008. In one survey, 22% of consumers reported going to the doctor less often, and 11% reported buying fewer prescription drugs.[49]

[edit] Health care payment

In the United States, doctors and hospitals are generally funded by payments from patients and insurance plans in return for services rendered.

Around 84.7% of citizens have some form of health insurance; either through their employer or the employer of their spouse or parent (59.3%), purchased individually (8.9%), or provided by government programs (27.8%; there is some overlap in these figures).[1] All government health care programs have restricted eligibility, and there is no government health insurance company which covers all citizens. Americans without health insurance coverage at some time during 2007 totaled about 15.3% of the population, or 45.7 million people.[1]

Among those whose employer pays for health insurance, the employee may be required to contribute part of the cost of this insurance, while the employer usually chooses the insurance company and, for large groups, negotiates with the insurance company.

In 2004, private insurance paid for 36% of personal health expenditures, private out-of-pocket 15%, federal government 34%, state and local governments 11%, and other private funds 4%.[50]

Insurance for dental and vision care (except for visits to ophthalmologists, which are covered by regular health insurance) is usually sold separately. Prescription drugs are often handled differently than medical services, including by the government programs. Major federal laws regulating the insurance industry include COBRA and HIPAA.

Individuals with private or government insurance are limited to medical facilities which accept the particular type of medical insurance they carry. Visits to facilities outside the insurance program’s “network” are usually either not covered or the patient must bear more of the cost (usually waived for emergencies). Hospitals negotiate with insurance programs to set reimbursement rates; some rates for government insurance programs are set by law. The sum paid to a doctor for a service rendered to an insured patient is generally less than that paid “out of pocket” by an uninsured patient. In return for this discount, the insurance company includes the doctor as part of their “network”, which means more patients are eligible for lowest-cost treatment there. The negotiated rate may not cover the cost of the service, but providers (hospitals and doctors) can refuse to accept a given type of insurance, including Medicare and Medicaid. Low reimbursement rates have generated complaints from providers, and some patients with government insurance have difficulty finding nearby providers for certain types of medical services.

Charity care for those who cannot pay is sometimes available from any given medical facility, and is usually funded by non-profit foundations, religious orders, government subsidies, or services donated by the employees. Massachusetts and New Jersey have programs where the state will pay for health care when the patient cannot afford to do so.[51] The City of San Francisco is also implementing a citywide health care program for all uninsured residents, initially available to those whose incomes are below an eligibility threshold. Some cities and counties operate or provide subsidies to private facilities open to all regardless of the ability to pay, but even here patients who can afford to pay or who have insurance are generally charged for the services they use.

The Emergency Medical Treatment and Active Labor Act requires virtually all hospitals to accept all patients, regardless of the ability to pay, for emergency room care. The act does not provide access to non-emergency room care for patients who cannot afford to pay for health care, nor does it provide the benefit of preventive care and the continuity of a primary care physician. Emergency health care is generally more expensive than an urgent care clinic or a doctor’s office visit, especially if a condition has worsened due to putting off needed care. Emergency rooms are typically at, near, or over capacity. Long wait times have become a problem nationally, and in urban areas some ERs are put on “diversion” on a regular basis, meaning that ambulances are directed to bring patients elsewhere.[52]

Categories:

Health care spending in U.S. exceeds costs of other countries

By Wikipedia

•

October 28, 2009

0