When I was in fifth grade, I had a class where I learned to crochet and had a square-dancing lesson in my physical education class. While I appreciate my poorly made scarves and handy square-dancing knowledge, I often wonder why my teachers chose these skills over things like nutrition, financial literacy and CPR. Every year, I cringe at the Turbo Tax commercials and face confusion every time I open my mail. I will be the first to admit I have no idea how to file my own taxes.

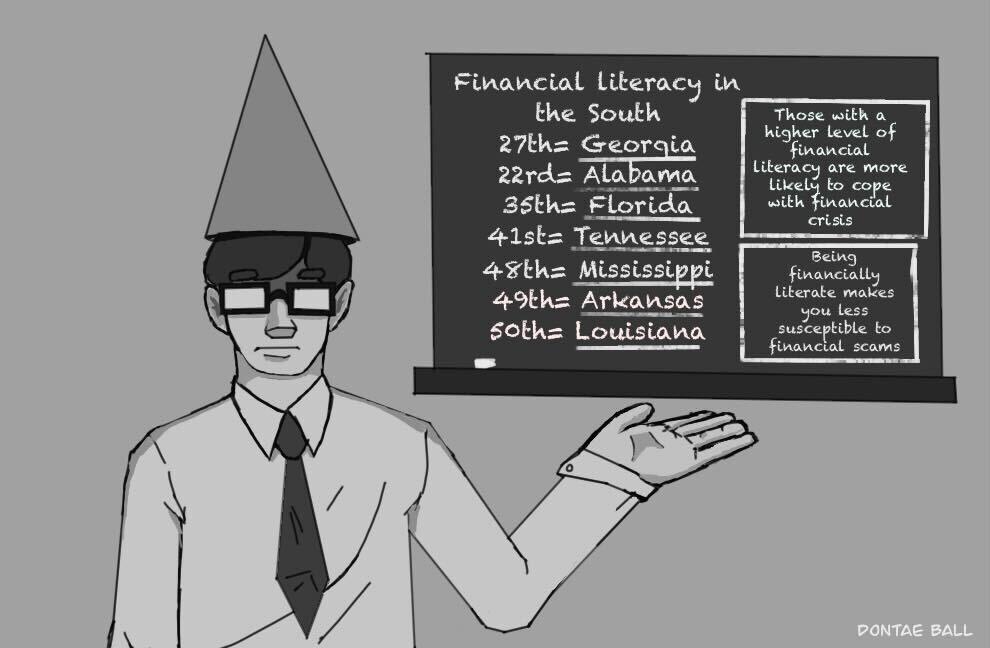

According to John S. Kiernan for Wallet Hub, Mississippi is ranked 48th for financial literacy, which is an essential skill of adult life yet is not taught effectively to Mississippi youth. This was my first year filing my own taxes, and to be honest, it was not an easy task. As someone whose experience with money is mostly on Amazon, there were terms, forms and questions I was far from familiar with. It was not until I broke down and used Turbo Tax that I reflected on my pathetic attempt to file for a tax return.

A majority of Americans, like me, are left perplexed by their finances. According to Tina Orem for Nerd Wallet, surveys found 46% of Americans cannot correctly name their tax bracket. The lack of financial literacy in public education affects more than just Mississippi.

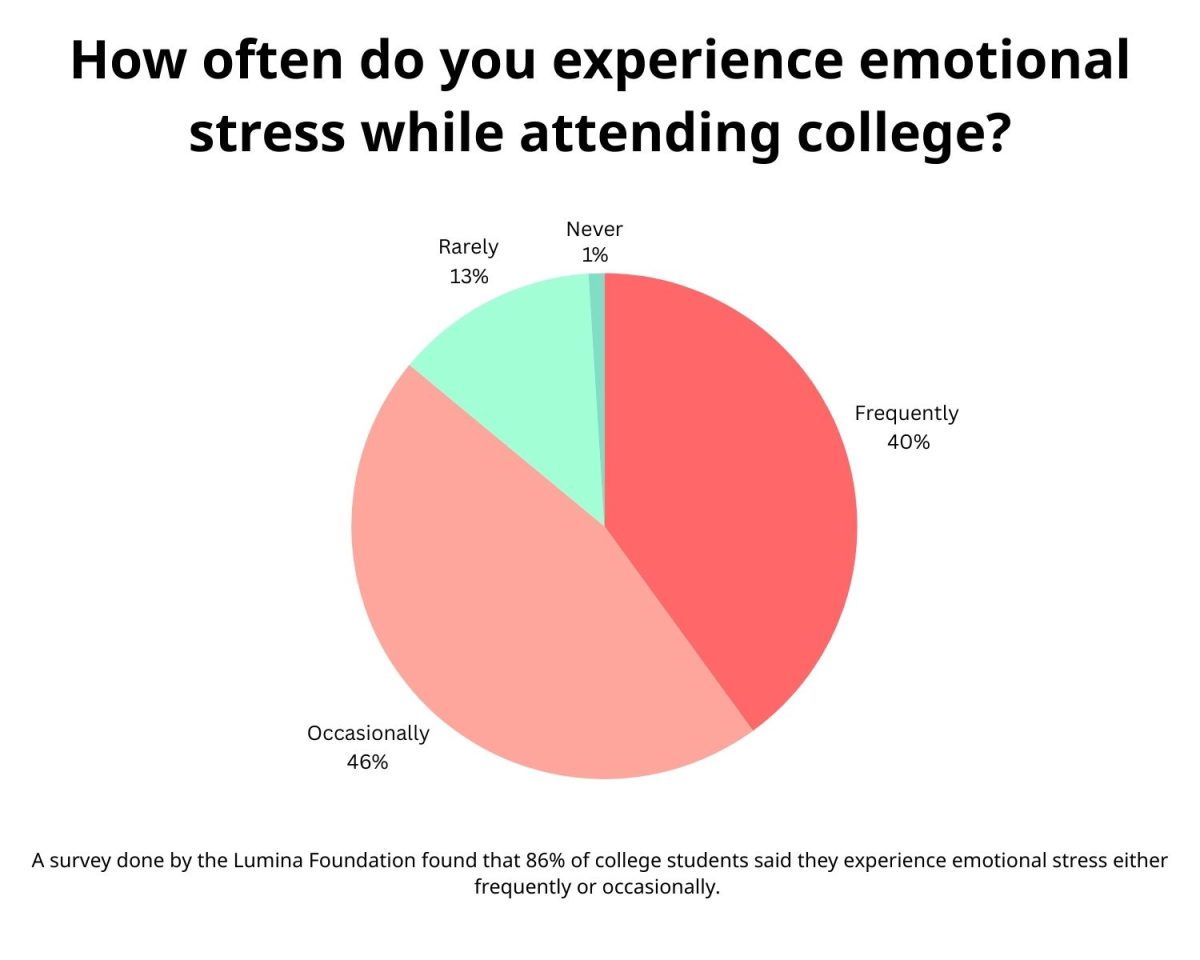

College students are the prime victims of this issue. These years are hard on everyone financially, but on top of that, we are faced with paying our bills for the first time in our lives.

In addition, there is a lot of financial responsibility being placed on people in this age group. Many students are paying rent, buying their own groceries, taking out loans, getting their first jobs and using credit cards for the first time.

The problem is magnified for this group because they have no experience with the economy and no knowledge of how to navigate it. We should be prepared for life before it hits us. Today’s climate enables financial hardship and makes it nearly impossible to regain any significant financial losses.

Oftentimes, students and other young adults are forced to balance expenses and incomes which they have no experience with. This problem has recently become very prominent in my own life, which is why it is necessary to provide financial education to all public education systems.

Michael Gruen for Forbes writes the best time to invest is in young adulthood. However, this is the stage of life where many people are uneducated about finances. Gruen describes many ways to invest money young to prepare for the future ahead. Many new investment strategies such as cryptocurrency and NFT’s (non-fungible token) have been introduced to attract young people to invest. Systems like this serve as a way to reintroduce financial literacy which can be understood by newer generations.

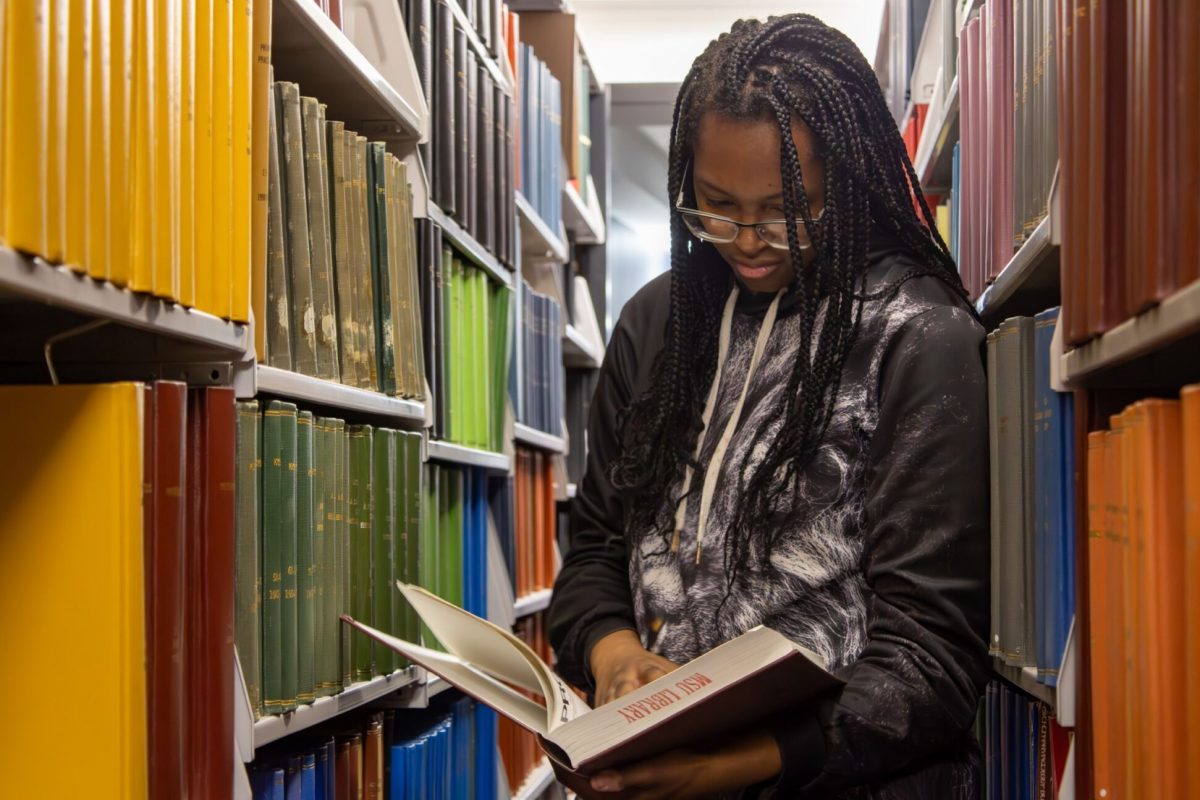

Financial education is not readily available to young people and continues to feed a culture of financial incompetence. High school and college are both environments which are supposed to prepare students for real-world responsibilities and skills. It is important these monetary skills are added to public school curriculum to promote a financially responsible future.

Categories:

Mississippi schools do not prepare youth to manage money or file taxes

About the Contributor

Lizzie Tomlin, Staff Writer

Lizzie Tomlin is a senior political science major. Lizzie is currently a staff writer for The Reflector.

0

Donate to The Reflector

Your donation will support the student journalists of Mississippi State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover